In an effort to better model how higher rates may affect leveraged ETFs and their ability to obtain low cost leverage I have been doing some backtesting for periods before and after the inception of SSO and UPRO. I have done this before, but am using a different method. Rather than assuming a roughly fixed cost for leveraged ETFs to obtain financing I am using the Federal Funds Rate plus a buffer. I imagine this would be a better simulation for environments with different borrowing costs. The method of calculation holds up very well over the periods that UPRO and SSO actually existed.

SYNTHETIC UPRO (3X S&P 500 ETF)

SYNTHETIC SSO (2X S&P 500 ETF)

SEE MY TRADES LIVE

The three links below will take you to a third-party website called collective2 where I record and publish my trading decisions.

Retirement Account #1:Patience is a Virtue

Retirement Account #2: My Roth IRA

Paper Trading Account #3: Leverage and Patience

1 Like

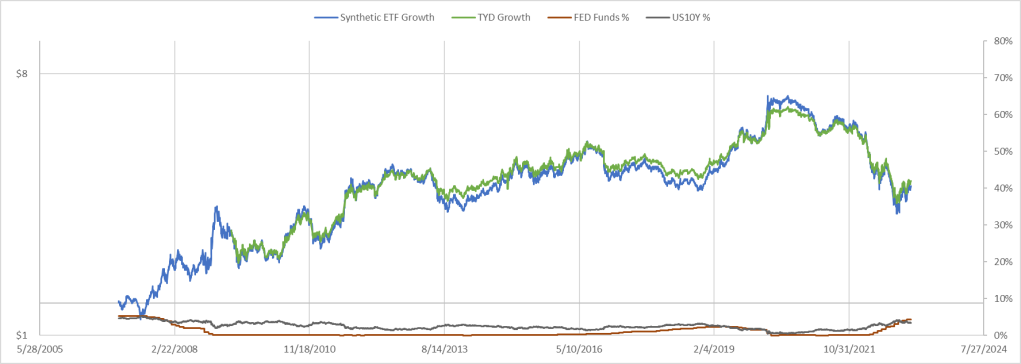

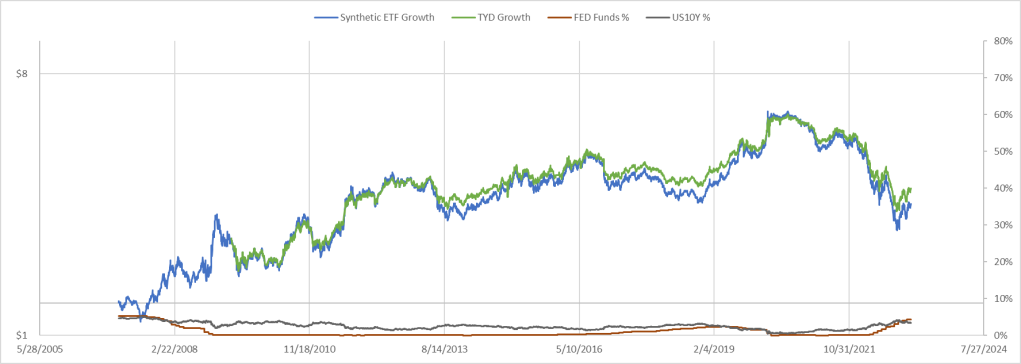

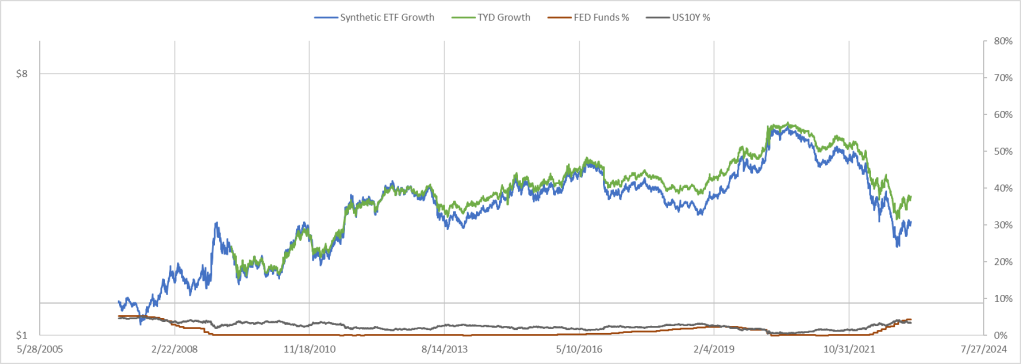

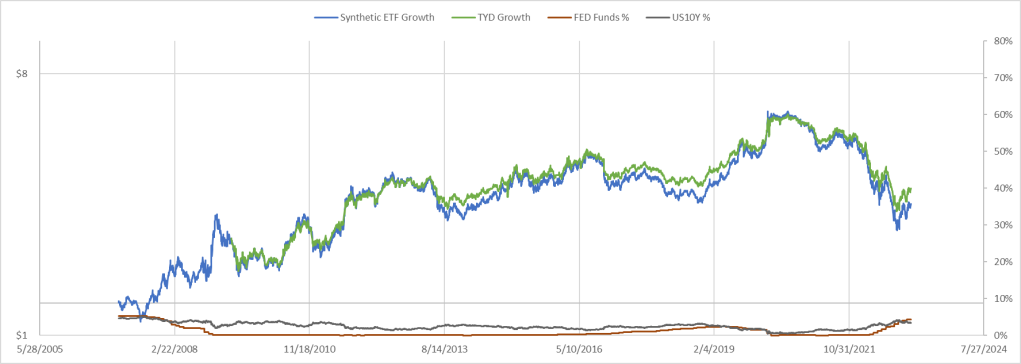

TYD Recreation

TYD is essentially a daily 3X version of IEF. It was started later, but we can see that for this particular period we can get a pretty close match simply by assuming no fees except for assuming a drag equal to 1 times the federal funds rate at that time.

Fee = 1X Federal Funds Rate

Fee = 2X Federal Funds Rate

Fee = 3X Federal Funds Rate

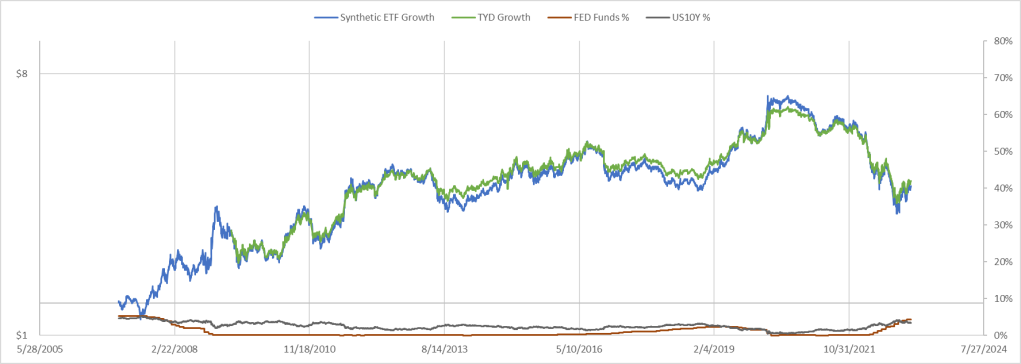

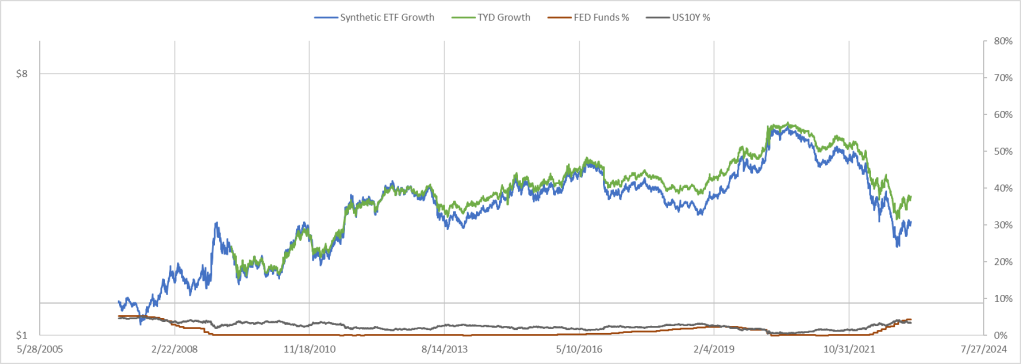

Best Way to Mimick TYD

To the best of my ability to tell the best way to mimic TYD for backtesting purposes is to assume a drag/expense of about 1X the federal funds rate at the time. It is hard to say for sure if this is accurate, but over this period it certainly gives the closest match to actual TYD. I don’t know exactly how leveraged ETFs are able to keep the costs this low, but so far it seems that they are. Part of me wonders if it could be offsetting swaps with short ETFs. For the most part you are then just matching investors and charging a small fee. I will continue to investigate what they are doing internally, but as of now this is a positive sign to see these funds doing so well at managing costs. It is certainly possible that this method only works in the period I have to compare to and that in other periods it is a terrible model. Regardless, I think it is interesting.

Full History Synthetic TYD

3 Likes