A new expiration of BITO options recently became available. The January 16th, 2026 options with 849 days to expiration are now available, and I am considering buying some in my funny money account. BITO does have the downside of a management fee and futures costs. However, it has tracked the price movement of Bitcoin remarkably well over its almost two year existence.

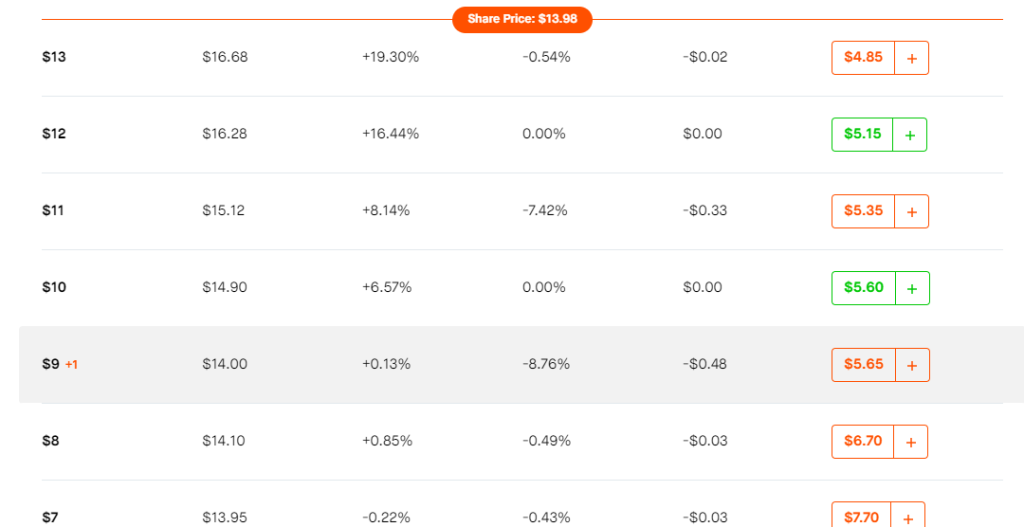

I was looking at the call options and quite amazed at the tiny jump in ask price from a 10 strike to a 9 strike. I bought one contract at $5.65. I couldn’t get it to go any lower. The intrinsic value at the moment is $4.98 leaving only $0.67 in leverage cost to capture the price movement of an extremely volatile asset for over two years. That seems like a great deal to me. That is an about 5% cost (0.67/13.98) spread over the course of over two years. Meanwhile I only have to outlay about 40% of the capital leaving the other 60% to allocated to my algorithms and other investment models. Obviously there is risk that Bitcoin will perform poorly. Other than that this seem almost too good to be true. What am I missing?