"Risk can not be destroyed, only transformed."

Corey Hoffstein

Corey has an Asset Management company whose focus is risk management. Last week, he published an interesting article called “Fragility Case Study: Dual Momentum GEM”, generating a passionate discussion on Twitter with Gary Antonacci, creator of “Dual Momentum GEM”.

Below I include the link of this publication, for people interested in risk management.

https://blog.thinknewfound.com/2019/01/fragility-case-study-dual-momentum-gem/

Best,

Gonzalo

Jim O’shaughnessy wrote the following tweet a few days ago:

1/Successful Active Investors Generally Ignore Forecasts and Predictions.

“I have no use whatsoever for projections or forecasts. They create an illusion of apparent precision. The more meticulous they are, the more concerned you should be.”

~Warren Buffett

Completely agree. IMO it’s a complete waste of time. 50% get it wrong and 50% get it right, typically flip flopping the next time. Usually the masses are also wrong in unison. Like the Buffett quote.

Couldn’t agree more @DogZebra_Investing! I haven’t met a forecaster that is rich from investing in himself yet except from the subs paying him for advice!

heres one way to predict-

Imagine getting a mail from a little known stockbroking firm. The mail predicts that a certain stock will rise this week. You leave the mail aside, as you have seen enough such mails.

Next week, the Baltimore Stockbroker mails again, with another tip-this time, of a stock going South. The message turns out right, and you decide to mark the Baltimore Stockbroker as ‘not spam’.

Week Three. Another hit. And your interest is piqued.

This goes on for ten weeks. Ten accurate predictions from the Baltimore Stockbroker.

You, the guy who recently retired with a substantial gratuity in the bank, are hooked.

Week eleven, the Baltimore Stockbroker sends you an offer to invest money with him, for a substantial fee of course. There is the usual caveat of past performances not guaranteeing future success, but the Baltimore Stockbroker nudges you to consider his ten week streak.

You do the math. Every week, the Stockbroker had a 50% chance with his prediction. Either he would be right, or wrong.

Combining the probabilities for ten weeks, the chances of the Baltimore Stockbroker to be right ten weeks in a row work out to… 1/2 x 1/2 x 1/2……ten times… =1/1024.

You consider. The Baltimore Stockbroker must be onto something. And it would be worthwhile to invest your nest egg with him.

You go in for the offer .

_ Things, from the view of the Baltimore Stockbroker, are a bit different ._

What he did, was start out with sending 10,240 newsletters!

Of these, 5120 said a stock would go up, and 5120 said otherwise.

The 5120 who got a dud prediction never heard from the Baltimore Stockbroker again.

Week Two, the Baltimore Stockbroker sent 2560 newsletters, and the following week he again halved the number, based on who got his correct prediction.

This way, at the end of week 10, he had ten people, convinced he was a financial genius.

That’s… The power of probabilities, cons, and the impact of mathematics on daily life… Just one aspect!

Borrowed from ’How Not to be Wrong: The Hidden Maths of Everyday Life’ by Jordan Ellenberg.

Yes @QFund! And of course they would highlight the winners and never mention the losers! lol…

¨Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves¨.

~Peter Lynch

I share with you an interesting publication by Morgan Housel called “Origins of Greed and Fear”.

Good article, as are all of Housel’s.

“Take index. Blindly invest monthly surplus for the next twenty years. You’ll be far ahead of many investors.”

~D. Muthukrishnan

Below I share with you a very interesting publication by Nick Maggiulli: Even God Could not Beat Dollar-Cost Averaging. The Problem with Buying the Dip

Best,

" If you looking for next 3 years return, valuation is important. For next 5 years or more returns, it is quality that is important".

~D. Muthukrishnan

A very important and interesting reading:

Which Factors?

David Tepper, the well-known Hedge Fund of Miami Beach and who manages about US $ 14 Billion, wrote a few days ago on Twitter: “The key is to wait. Sometimes the hardest thing to do is to do nothing”.

On that same Twitt, Jim O’shaughnessy, author of the well-known book “What Works on Wall Street” commented: "A hunger for action leads to many an investor’s downfall. Try an experiment. See if you can sit quietly in a room, just for 10 minutes. No books, no music, no phone, no computer, nothing.

You might be surprised at how hard it is. Oh, and do it when the market is open. "

While I wait, I like to read. In recent years I have read many interesting papers like"All About Factors."

Two solid well known quotes.

I feel like with the exception of early 2016 when high yield spreads blew out, the last 5-6 years has been just waiting for me…

In the following lines, you can read an interesting post: “Waiting for the Market to Crash is a Terrible Strategy”, published by SVRN Asset Management.# SVRN Asset Management

Waiting for the Market to Crash is a Terrible Strategy

In my experience, investors sitting on a lot of cash are usually worried about equity valuations or the economy, and tell themselves and others that they’re going to buy gobs of stock after a crash. The strategy sounds prudent and has commonsense appeal—everyone knows that one should be fearful when others are greedy, greedy when others are fearful. But historically waiting for the market to fall has been an abysmal strategy, far worse than buying and holding in both absolute and risk-adjusted terms.

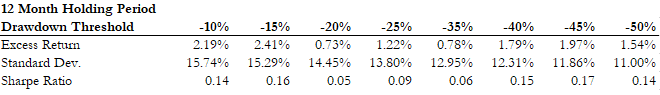

Using monthly U.S. stock market total returns from mid-1926 to 2016-end (from the ever-useful French Data Library), I simulated variations of the strategy, changing both the drawdown thresholds before buying and the holding periods after a buy. For example, a simple version of the strategy is to wait for a 10% peak-to-trough loss before buying, then holding for at least 12 months or until the drawdown threshold is exceeded before returning to cash. This strategy would have put you in cash about 47% of the time, so if our switches were random, we’d expect to earn about half the market return with half the volatility.

The chart below shows the cumulative excess return (that is, return above cash) of this variation of the strategy versus the market. Buy-the-dip returned 2.2% annualized with a 15.7% annualized standard deviation, while buy-and-hold returned 6.3% with an 18.6% standard deviation. Their respective Sharpe ratios, a measure of risk-adjusted return, are 0.14 and 0.34, meaning for each percentage point of volatility buy-the-dip yielded 0.14% in additional annualized return and buy-and-hold yielded 0.34%.

The above chart understates the terribleness of the strategy. In the chart below I plot the cumulative wealth ratio of the strategy over the market to show their relative performances. When the line is sloping down, dip-buying is underperforming; when it’s sloping up, it’s overperforming. As you can see, the line shows small jags of outperformance, expansive plateaus of neutral performance, and long rolling slopes of underperformance.

What about waiting for a deeper crash? For every drawdown level from -10% to -50% (in increments of 5%), waiting for a crash before buying results in lower absolute and risk-adjusted returns.

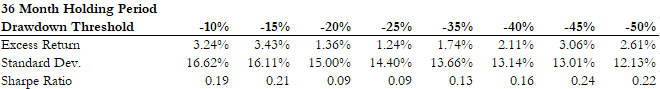

What about holding on longer? This helps, but not enough to make it a winning strategy. Here’s what holding for three years after a crash produces:

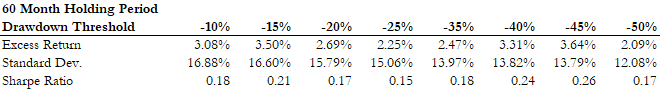

Holding for five years helps, too, but now we’re getting closer to buy and hold:

None of the variations tested produces higher absolute or risk-adjusted returns than buy and hold.

The strategy fails for two reasons. First, the historical equity risk premium was high and decades could pass before a big-enough crash, making it very costly to sit in cash. Second, the market tended to exhibit momentum more than mean reversion over years-long horizons. As strange as it sounds, you would have been better off buying when the market was going up and selling when it was going down, using a trend-following rule.

The closest thing to a success is waiting for a 40% or 45% crash before buying, and then holding on for at least five years. That strategy would have captured more than half the market’s return while being exposed to the market only a third of the time. However, 40%+ crashes are rare, occurring only five times in our sample, or about once every 18 years. The best that can be said for our strategy is that medium-term returns after a big crash tended to be above average, so it’s probably a good time to buy equities if you have cash sitting around and a multi-year horizon.

This data does not say you should always buy and hold, no matter what. It simply says that a mechanical strategy of waiting for a crash on average resulted in much worse absolute and risk-adjusted returns than buying and holding. It is conceivable that you could have some piece of information—say, market valuations or economic conditions or technicals—that indicates a big crash is more likely to occur. In fact, a drawdown from a prior peak is itself just such a piece of information, because bad returns tend to clump together.

This is probably the best thing I have ever seen on this forum. Well done sir.

Very interesting read.

how would this hold up if we dial this back from 1990/2000 till Now ? So much had changed with the market, growth rate in the economy, invention of algo trading. A brand new era has changed so much in trading the past 10-20 years. Seeing the data of the greatest growth era we had in comparison to the new era of algo trading is always going to bias towards long term investors. This is same as showing a chart of someone who only bought FANG stocks since 2000 vs someone who is buying SPY, making a point of being diversify is a bad idea.

I’m not saying buy and hold or BTFD is better, they are both valid strategy and its a good idea to have implement both. To each of their own has their benefits and fits different types of investors.

Is Direct Indexing Really The Next $100-billion Financial Advisor Opportunity?

Maybe I’m being dense, but I have no clue after reading this article how “direct indexing” led by an “advisor” and with each stock of some index optional is anything but a directed equities account with its own holdings, commissions and perhaps even advisor fees on top. Seems like a repackaging/rebranding of what things were like before mutual funds, except with “indexing” in the package title; a ploy for stock advisors to get their mojo back. I’d love to know what I’m missing about this $100B opportunity for financial advisors that might possibly benefit investors (tax harvesting aside).

A #riskmanagement plan needs to include:

-How much you’ll risk per trade

-How you’ll manage your trade

-How you’ll exit your winners

-How you’ll exit your losers

A Gentle Guide to Global Tactical Asset Allocation

Very interesting post by Corey Hoffstein.

https://blog.thinknewfound.com/2017/08/gentle-guide-global-tactical-asset-allocation/