Swing trading based on trend following involves identifying and capitalizing on short- to medium-term price movements within the context of a broader trend. Here’s a step-by-step approach to swing trading based on trend following:

-

Identify the Trend: The first step is to identify the direction of the prevailing trend. This could be done using technical analysis tools such as moving averages, trendlines, or trend indicators like the Average Directional Index (ADX) or Moving Average Convergence Divergence (MACD). The trend could be bullish (upward), bearish (downward), or sideways (lateral).

-

Find Swing Points: Once the trend is identified, look for swing points within that trend. Swing points are areas where the price temporarily reverses before continuing in the direction of the trend. These swing points can be identified using tools like support and resistance levels, Fibonacci retracement levels, or chart patterns such as triangles or flags.

-

Entry Signal: Wait for confirmation of a potential swing trade entry. This confirmation could come in the form of a breakout above resistance (for long trades) or a breakdown below support (for short trades), accompanied by increasing volume and other technical indicators supporting the trade direction.

-

Set Stop Loss and Take Profit Levels: Determine your risk management strategy by setting stop-loss orders to limit potential losses if the trade moves against you. Stop-loss levels are typically placed just beyond the swing point or a significant support/resistance level. Additionally, set profit targets based on the potential price movement and risk-reward ratio.

-

Manage the Trade: Once the trade is initiated, actively manage it by monitoring price action and adjusting stop-loss and take-profit levels accordingly. Trailing stop-loss orders can be used to lock in profits as the price moves in your favor.

-

Exit Strategy: Exit the trade when the price reaches your predefined take-profit level, when the trend shows signs of reversal, or when the trade reaches your stop-loss level. It’s important to stick to your trading plan and not let emotions dictate your decisions.

-

Review and Learn: After each trade, review your performance and analyze what worked well and what didn’t. Learn from your mistakes and refine your trading strategy accordingly.

Remember, swing trading based on trend following requires patience, discipline, and a thorough understanding of technical analysis concepts. It’s essential to practice proper risk management and avoid overtrading to maximize your chances of success in the long run.

You’ve had a good month on your trades, and that’s an admirable and sensible approach to swing trading. Your trading record seems to indicate you set your stops tight and indeed update and trail them well… I can’t tell for sure, but I suspect a lot of your very small gains come from a trailing stop that has been moved up with the trend, rather than a very tight profit target. Thanks for sharing.

1 Like

Hi Babbage_9010,

Thank you for your comment.

It’s certainly possible that trailing stops play a role in capturing small gains as a trend progresses. Trailing stops are a risk management technique used by traders to protect profits by adjusting the stop-loss order as the price moves in their favor. As the price continues to rise, the trailing stop moves up accordingly, locking in gains and potentially allowing for further profit if the trend continues.

In contrast, tight profit targets involve setting a specific price level at which to exit a trade for a predetermined profit. While this approach can be effective in certain market conditions, it may also limit potential gains if the price continues to move in the trader’s favor beyond the target level.

Both trailing stops and tight profit targets have their pros and cons, and different traders may prefer one over the other based on their trading style, risk tolerance, and market conditions. Ultimately, the choice between trailing stops and tight profit targets depends on the individual trader’s preferences and their assessment of the market environment.

Forex trading offers several advantages over stock trading, including:

-

High Liquidity: The forex market is the largest financial market in the world, with daily trading volumes exceeding trillions of dollars. This high liquidity ensures that traders can enter and exit positions quickly at any time, with minimal slippage.

-

24-Hour Market: Unlike stock markets, which have specific trading hours, the forex market operates 24 hours a day, five days a week. This allows traders to react to global events and news as they happen, without having to wait for the market to open.

-

No Insider Trading: The forex market is highly decentralized and operates over-the-counter (OTC), meaning there is no central exchange or regulatory body overseeing all transactions. While this lack of centralization may raise concerns about transparency, it also means that all traders have equal access to market information, reducing the likelihood of insider trading.

-

Greater Market Predictability: Forex markets are influenced by macroeconomic factors such as interest rates, inflation, and geopolitical events. These factors often lead to more predictable price movements compared to individual stocks, which can be affected by company-specific news and events.

-

Diverse Trading Opportunities: In the forex market, traders can speculate on the price movements of currency pairs from economies around the world. This diversity provides ample trading opportunities, regardless of whether global markets are rising or falling.

Overall, forex trading offers flexibility, accessibility, and potentially higher liquidity compared to stock trading. However, it’s essential to recognize that both markets carry inherent risks, and traders should conduct thorough research and practice risk management strategies to mitigate losses.

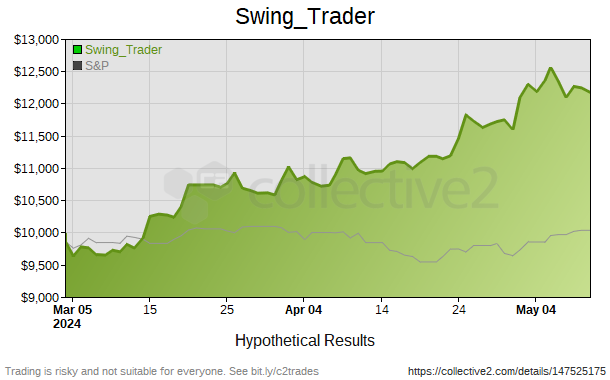

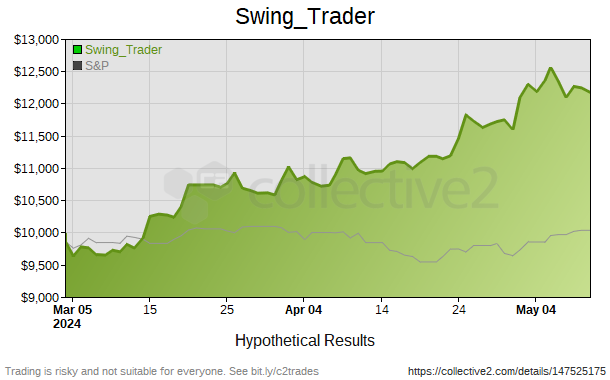

A picture is worth a thousand words!

1 Like

That is a very nice equity curve.

1 Like

Thank you. I appreciate your kind comment

1 Like

Impressive start. Where can this strategy be autotraded? IBKR is a no-go for forex. Thanks.

1 Like

Sure! IMO, IBKR is the best broker on C2!

1 Like

Sorry, let me clarify. IBKR is not an option for me, as I live the U.S. Does your strategy support another forex broker (available to U.S. customers)? Thanks.

1 Like

Hi Dylan,

Our 2 US Forex Brokers are IG Markets And StoneX (Forex.com).

Our contact Trey Lazarra, can help you choose the right one and get setup with the right account for autotrading on Collective2. His email is trey@tradeprofutures.com.

In general, any of our Strategies can be autotraded by all of our supported brokers, it’s just a question of which ones can be used by a particular investor.

2 Likes

Hi MarcMayerson111,

I’m so grateful for your ongoing support.

Dear Mr. Matthew Klein,

I closed all my trades on Friday, May 31, with a balance/equity of $12,805.

However, today (Sunday, June 2), the balance/equity shows $12,572, despite no trades being opened or closed over the weekend.

This resulted in a lower “Cumul. Return” and a worse “Max Drawdown”. Why is this happening?

Thank you.

SwingTrader

Remember you charge $200 per month. We also add typical autotrading fee (as required by regulators). This cost is applied to each strategy every 30.5 days.

1 Like

I was so confused, but your explanation made it clear. Thanks for taking the time to explain. It was very helpful!

1 Like

Dear Mr. Matthew Klein,

Last week (Sunday, June 2nd), my “Cumul. Return” was 25.7%. This week (Saturday, June 8th), it is 34.8%. That’s a +9.1% increase. However, why does June only show a +5.3% return?

Thank you.

SwingTrader

You had a 9.1% increase from your initial investment and a 5.3% increase from your equity at the end of May.

2 Likes

@ GaryLynn2,

Thank you for clarifying that.