I don’t disagree. I’m saying if I want to follow a currency strategy that says they will only use up to 10 times leverage I want a safeguard provided by C2 that makes it so my account won’t try to copy trades with more leverage than 10 without prior warning etc.

He was entering naked call positions which essentially exposes him to infinite losses. He was entering these positions with, of all companies, Tesla

I guess traders shy away from options volatility strategies driven by the need to maximize returns.

Got killed shorting TSLA.

Has anyone checked Tax the Rich strategy? It was at #1 and look at it now… WOW.

These whipsaw markets will expose these high risk strategies. The VIX futures curve shows rocky times ahead.

He’s just having fun.

Some things I realized, markets can always break a system, because new things/patterns/ways of reacting occur (the new patterns that break a system may not necessarily be whipsaw, a system may be able to handle whipsaw from past few years but not the current whip-saw patterns). No matter what I feel any system will suffer when the system “doesnt work as well” or “doesn’t work at all” anymore. The thing is to change and change fast (definition of “fast” depends on if system is swing/short term, etc).

One way to prepare ahead of time and react automatically to changes in markets like this is to be hedged ahead of time (for example being long stocks 60% of your funds and having 40% in VIXM for example, or in cash at all times).

BTW what I mean by “change” a system doesn’t mean reset and start over, for example if using machine learning, it means to retrain and also re-adjust the model, maybe adding new features or changing the way it operates.

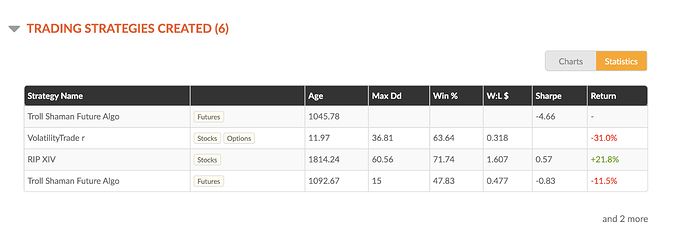

Time will tell which strategies can adjust to survive and hopefully thrive in the markets ahead. I am not an algorithmic trader, but it sounds like you are. Your strategies have has phenomenal success and I think a lot of people are curious on how they will perform the next few years. It sucks seeing some perform well for a few years then collapse screwing investors.

I tried many years to build a robust forex robot, which I was defining the strategy and programming it my self. I had a few successful runs, that lasted from a few weeks to a few months. But in the end all failed. I gave up from trying more than 10 years ago, because it was hurting my wallet, and because with much less effort I managed consistently positive returns on my stock investments. Off course I tried first with the demo accounts, and only the successful versions went to live accounts. But sooner or later the live account suffered a heavy loss.

I am following AI TQQQ SQQQ swing with a small account. And I am crossing my fingers that this strategy doesn’t screw up big.