Federal Reserve’s dual mandate

The Federal Reserve is vested with a dual mandate in pursuit of its economic goals. The dual mandate comprises:

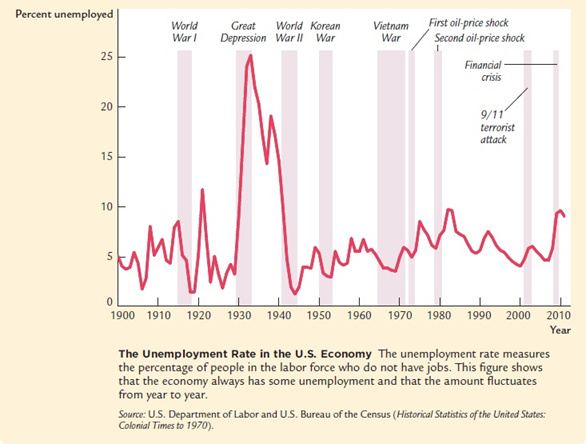

- Maximum employment: It means that the unemployment rate remains at the long-term natural rate of unemployment around which the economy fluctuates. In a recession the actual unemployment rate rises above the natural rate, and in a boom the actual unemployment rate falls below the natural rate.

Source: “Macroeconomics” by N. Gregory Mankiw

- Price stability: It means that the inflation rate remains low and stable. This ensures that the purchasing power of money is preserved, while maintaining sustained economic growth. The Federal Reserve typically targets 2% inflation which they believe keeps businesses profitable and prevents consumers from waiting for lower prices. The primary function of low and stable inflation is to prevent deflation.

Source: “Macroeconomics” by N. Gregory Mankiw

Positive aspects of mild and stable inflation

Let’s start with an example. Home owners always favor mild inflation. Let’s say, you bought a home for $400,000.00 in 2009. With all the inflation over the next 10 years your house is now worth $600,000.00. However, your mortgage repayments are taking smaller share of your income. Also, you are repaying with money that is less valuable than the money you borrowed.

Mild and steady inflation causes borrowing and spending to go up, and that increases spending at all levels. On the other hand, deflation or falling prices increase the value of debt. Ironically, the US government, being the most indebted debtor in the world, would always prefer mild and steady inflation.

Famous British economist John Maynard Keynes thought that some inflation is necessary to prevent ‘Paradox of Thrift’. When consumers expect deflation, they hold off making new purchases and wait until the prices drop. The net effect is reduced aggregate demand leading to lower output, layoffs and faltering economy.

What does the Fed look at?

The Federal Reserve targets only the headline PCE (Personal Consumption Expenditures) and nothing else. James Bullard wrote in a 2012 Regional Economist article, “The FOMC will target the headline inflation rate as opposed to any other measure (e.g., core inflation, which excludes food and energy prices) because it makes sense to focus on the prices that U.S. households actually have to pay.”

Terms of Use/Disclaimer

The information presented here is the property of QuanTimer and is protected by applicable copyright, intellectual property laws. No permission is granted to the readers of this forum to copy and distribute the content without prior written consent of QuanTimer. The analyses provided by QuanTimer are believed to be accurate and written in good faith, but no representation or warranty is made as to their accuracy. We do not guarantee profitability of any investment strategies discussed in our blog posts, or their suitability for your purpose. You bear the sole responsibility for your investment decision.