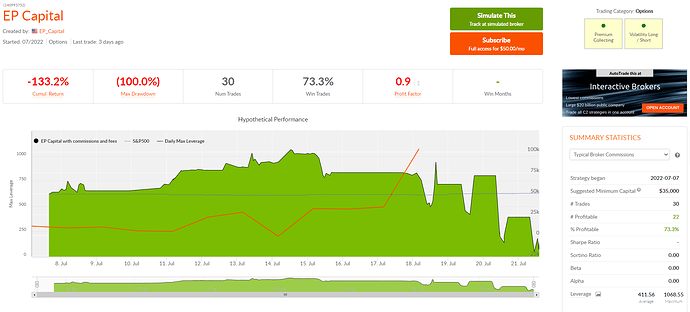

If either of you are interested here are some results

Just revisiting some strategies I was watching. I don’t know what it takes for people to listen. I was going to blog about this one, but it imploded before I got a chance.

I’m glad you are paying attention. I certainly don’t see my strategy in the same category. If you do that is completely fine. I know this year sucks. I have warned many times that there would be years like this.

I have a 3 plus years track record with an over 30% annualized rate of return. That doesn’t mean it necessarily will in the future of course, but that is way different than having a 100% drawdown in a matter of weeks from using over 100 times leverage.

I expect there to be times where my strategy doesn’t work well. However, if people just stick with it I think they will do better than the vast majority of investors and C2 subscribers. For example, in this post I made over two years ago, when I had over 78% annualized returns, I was warning subscribers they would need to be patient. Things wouldn’t always be as good as they looked there. Likewise, now things won’t always be as bad as they look for my strategy. Patience and consistency are crucial! Patience is a Virtue - #30 by InteractiveAssets

This approach is completely different than using 100 plus leverage and doubling down when trades move against the system. I wish you the best @Mate_see2

So according to your backtest (see link below) your system can turn $40K into …$40 Millions in 16 years, with less than 30% drawdown!

Add another 16 years and now you are richer than Bill Gates or Buffet (Collective2 fees included, of course).

Interesting, to say the least.

At certain sizes you simply can’t make trades without moving the markets etc. Those backtests are not me saying that it will get that percentage etc. Backtesting from 2004 through 2020 doesn’t cover many of the things that can happen.

My point is that using limited leverage to invest in mostly appreciating assets makes a lot of sense. However, if you use too much leverage or trading too much you end up destroying yourself.

From 1978 to 2022 US stocks had an annualized return of 11.36% and Long Term Treasuries an annualized rate of 7.66%. If you managed to invest in both with 50/50 mix and a daily leverage factor of 3X how well would you have done? 3X Leverage Simulation.

We don’t know what the future holds. I can almost guarantee I won’t be turning $40K into $40 Million in 16 years with a 54% annualized rate of return. However, I think if you take the teachings of passive investors, mix it with a little bit of leverage, and add in some risk management you may be able to get some pretty astounding results. However, patience and consistency are still going to be crucial to success during periods like right now!

FYI if you do the same backtest with 6X leverage you implode. Now if you go do it with 6X leverage or more then it become simply too easy to blow up your account. See here how the same backtest with more leverage implodes! 6X leverage simulation. As we keep seeing people do…

EDIT: Let me simplify the example

3X Leverage with 50% Stock 50% Bond

10X Leverage with 50% Stock 50% Bond

PS in that 3X Leverage with 50% stock and 50% bond strategy it is down roughly 68% this year making it the worst year (so far) for this hypothetical strategy in 40 years. Mine is down about 40%, which is terrible, but certainly better than 68%.

Do whatever you want. I doubt EP Capital is going to be using this thread after a 100% drawdown and -133% cumulative return.

I can’t remember exactly, but there is a verse or two about dogs, vomit, pearls, and pigs.

If you find the math to show why my strategy is doomed to have a 100% drawdown please advise. I would like to know. I feel that I saw why EP Capital was doomed to fail, but my warnings were ignored. Why do I keep thinking about pearls and pigs…?

I’m just saying that “if” you do please do warn me. That’s all I tried to do for EP.

Add all you want. If warnings from the SEC, C2, and the vast majority of the investing community can’t convince you that MORE LEVERAGE EQUALS MORE RISK, I’m sure I can’t convince you of that either. Good luck!

If, AND ONLY IF, “more” leverage means a bigger stop per trade (in percentage of capital) then YES, YES and YES, more leverage = more risk.

Traders who risk 60% of their capital on each trade, for instance, will lose all their money in no time, no matter how profitable their system is, it is a mathematical certainty.

However, if the trader simply and naively defines “leverage” as value of the financial instrument divided by trading capital then he is in for a rude awakening.

I will soon give more details in your Leverage Matters thread.

You are so close! As we have discussed, the likelihood a stop gets hit increases with increased leverage use.

This applies to scenarios with stops at the same underlying stop price and stops at the same % of capital.

To clarify, if you have the same stop level in two scenarios and one has more leverage then more is at risk. If you have two scenarios with the same % of capital at risk on a particular instrument the scenario with more leverage will require a stop closer to the current price - making it more likely to be hit.

Maybe the simplest way to phrase it is that max loss alone is not an all encompassing term for risk. You have to consider the instruments being traded and the probability of the max loss being achieved etc.

ALL ELSE BEING EQUAL, MORE LEVERAGE MEANS MORE RISK.

No.

How frequently a stop is hit has nothing to do with the profitability of a system, regardless of leverage.

Again, the hard stop must be dictated by the logic of the trading system itself. Traders cannot simply say something like this : “OK, I am willing to lose 5% on this trade, so I will place my stop here…”

No.

Yes.

Good money management implies at least two things:

1: A reasonable risk per trade (in percentage)

2: A reasonable risk at the portfolio level (in percentage).

Yes and no, it all depends on your definition of leverage, more on that later, as explained above.

Good luck with your strategies!

I agree , the only solution is to deleverage as possible .

According to his track record he made $ 91950 in 2 weeks.

Trade is not finished yet.

trade is not finished yet, next week we getting a huge pull back in the markets I should be in the green before expiration.

Perhaps, and I wish you the best.

Personally I NEVER try to predict the direction of the market, I just trade what the market is doing RIGHT NOW.

Now, as far as your EP_Capital system is concerned, watch out for these short option calls, they require very very strict money management rules, due to their unlimited risk potential, as you already know.