Thanks mate,

Yeah, 50:1 is just the same with the master account in C2…

Therefore I think it’s necessary to well control the risk especially for clients with large balance.

Have a green day !

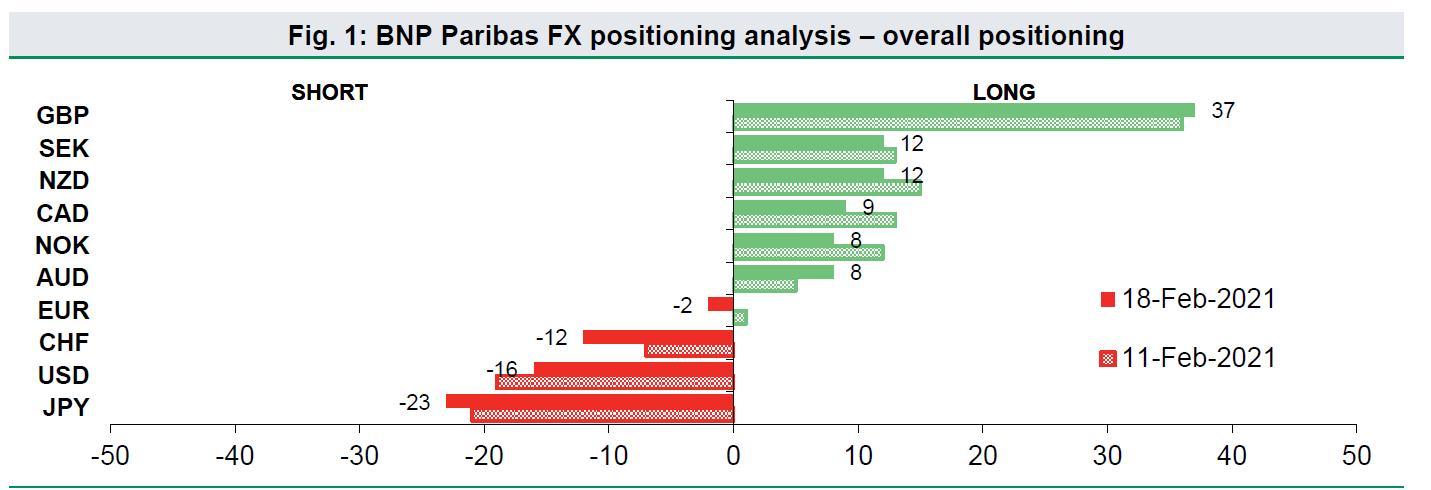

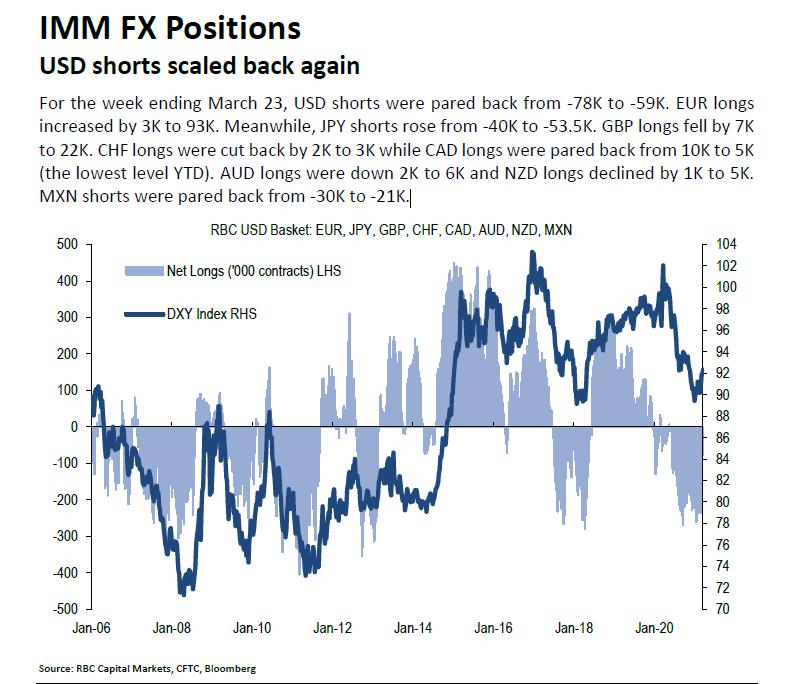

IMM FX Futures Position

Real time position analysis from a FX community.

Looks very pain for now.

The rescale result looks disappointed indeed.

Fortunately I left “TendencyForex” unchanged.

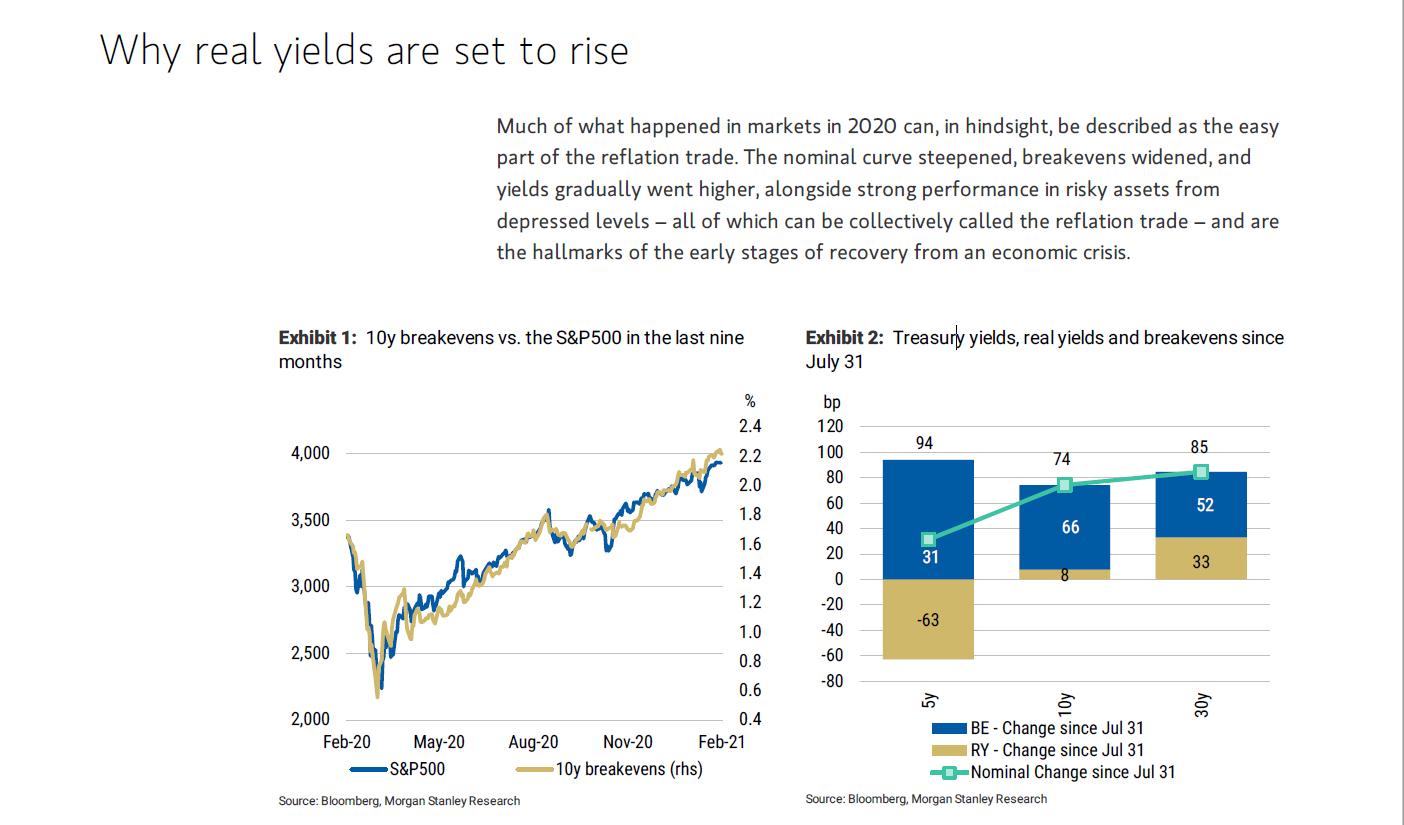

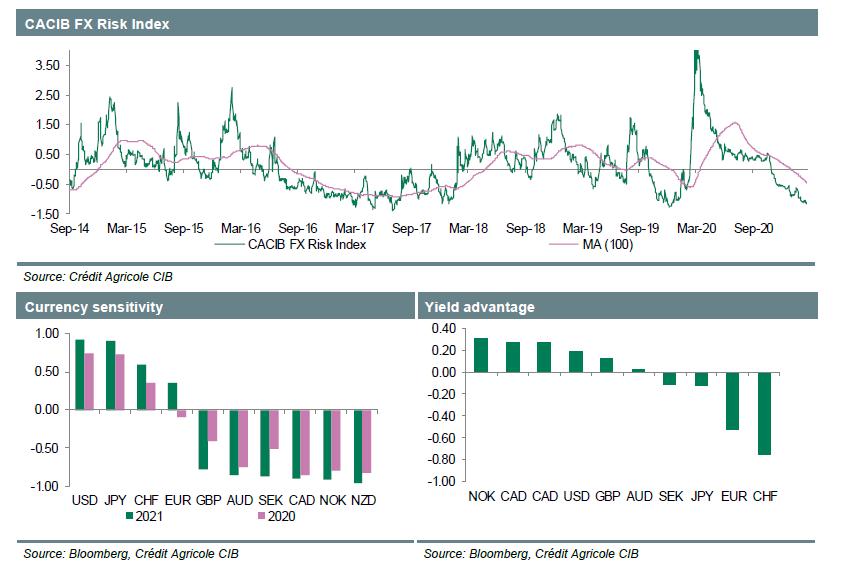

Much of what happened in markets in 2020 can, in hindsight, be described as the easy

part of the reflation trade. The nominal curve steepened, breakevens widened, and

yields gradually went higher, alongside strong performance in risky assets from

depressed levels – all of which can be collectively called the reflation trade – and are

the hallmarks of the early stages of recovery from an economic crisis.

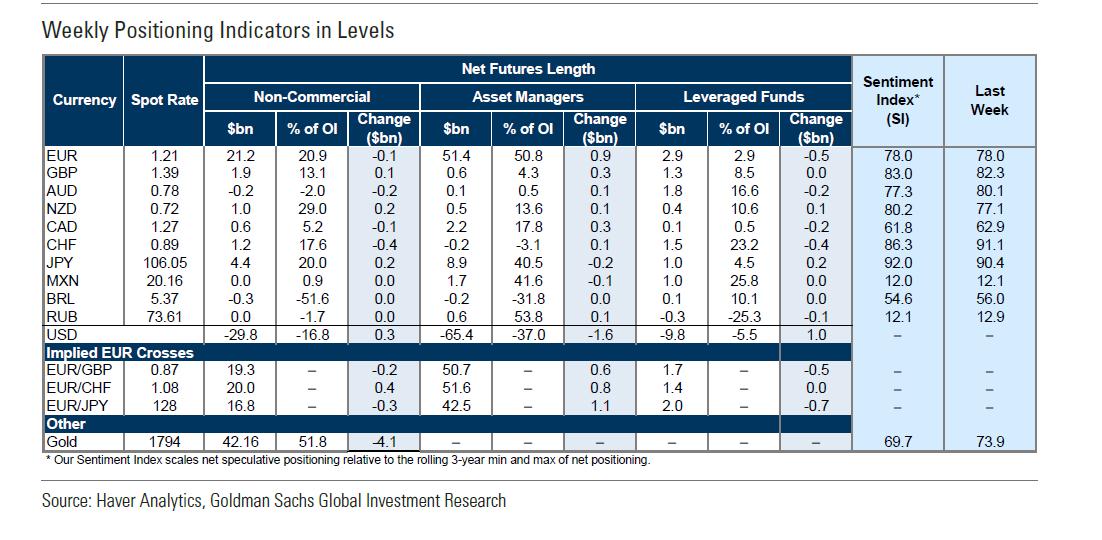

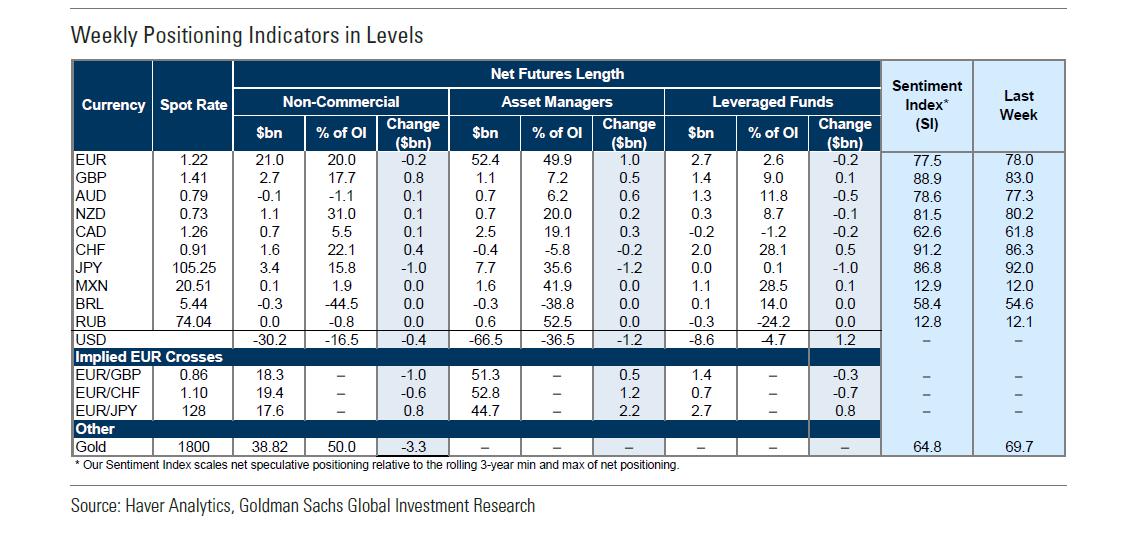

For the week ending March 23, USD shorts were pared back from -78K to -59K. EUR longs

increased by 3K to 93K. Meanwhile, JPY shorts rose from -40K to -53.5K. GBP longs fell by 7K

to 22K. CHF longs were cut back by 2K to 3K while CAD longs were pared back from 10K to 5K

(the lowest level YTD). AUD longs were down 2K to 6K and NZD longs declined by 1K to 5K.

MXN shorts were pared back from -30K to -21K.

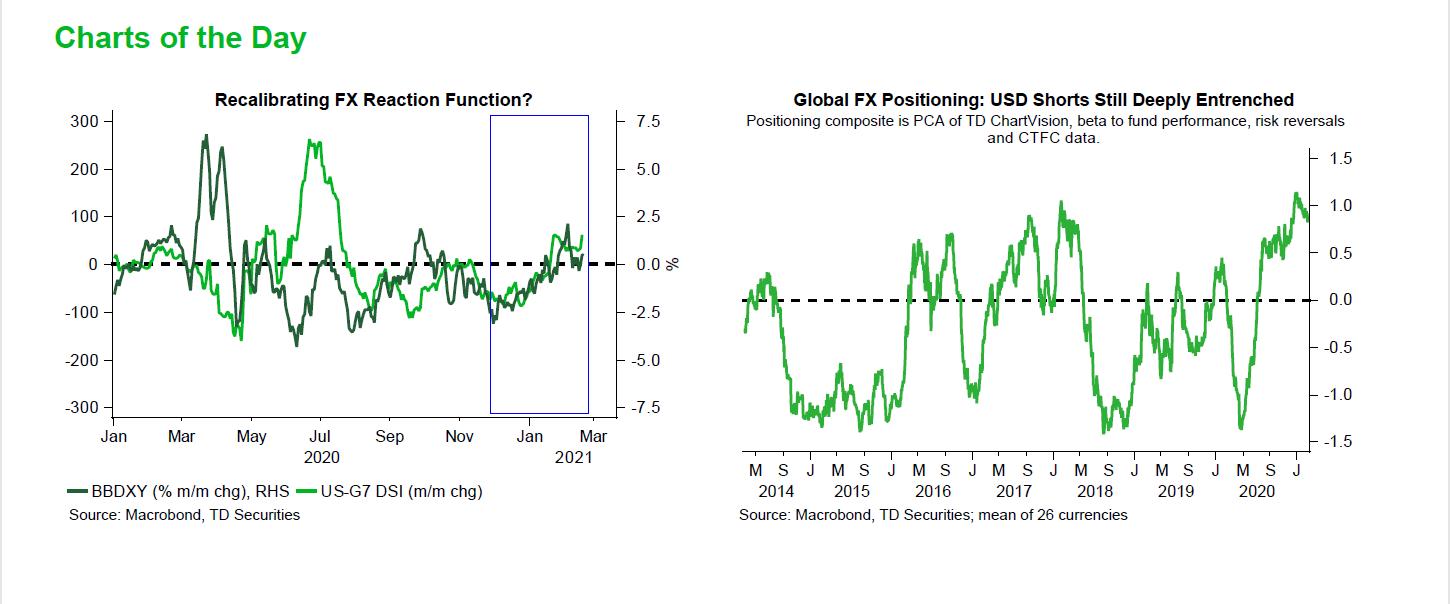

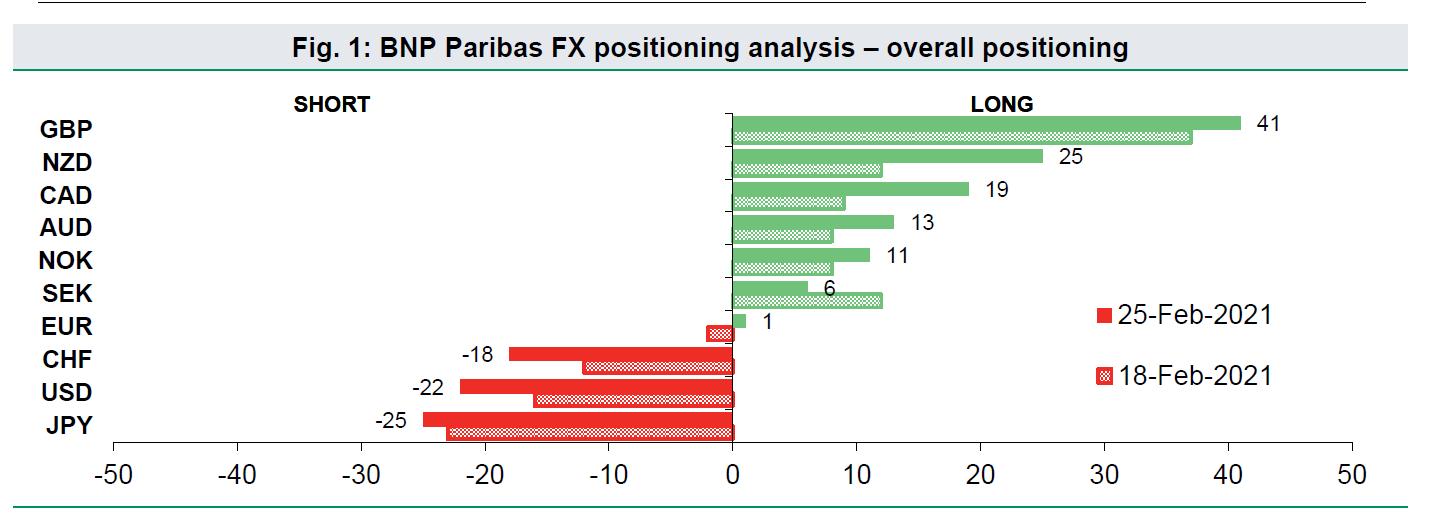

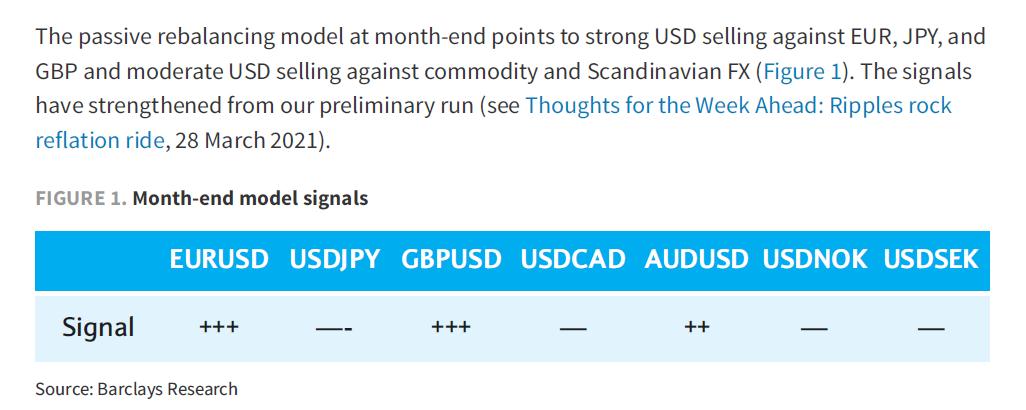

The passive rebalancing model at month-end points to strong USD selling against EUR, JPY, and

GBP and moderate USD selling against commodity and Scandinavian FX (Figure 1). The signals

have strengthened from our preliminary run (see Thoughts for the Week Ahead: Ripples rock

reflation ride, 28 March 2021).