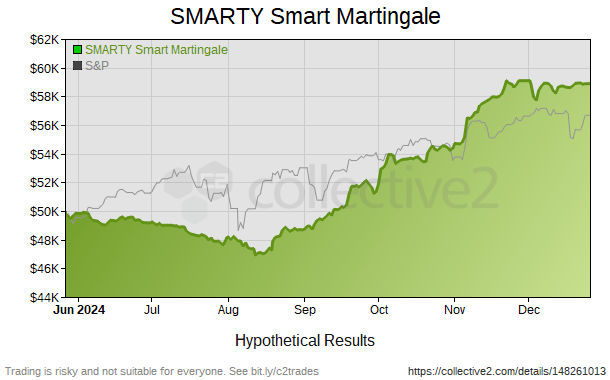

No News is turning out to be GOOD News! - SMARTY - Smart Martingale had a pretty uneventful month according to the chart but holding serve vs the S&P turned out to be a major accomplishment for the past week. Looking at the market just reinforces my LOVE for Forex. Up/Down markets dont matter since its so easy to reverse positions.

Internally I’m really excited (and a little frustrated). After working on this algo for YEARS I’m still stunned that I can find tweaks that can boost results more than just a fraction. I thought I was past the “if only this change was running since…” stage. Jan/Feb usually starts out flat for me but 2025 has been exceptionally volatile due to USA policy.

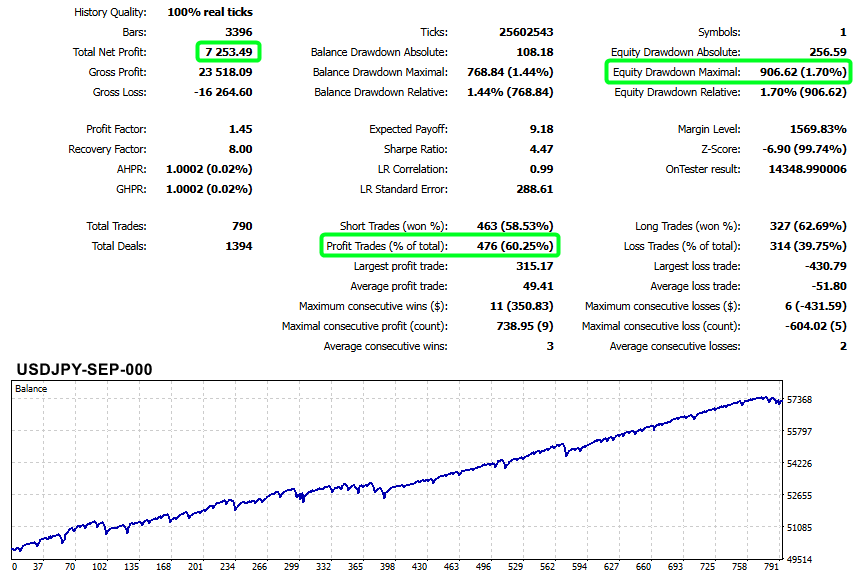

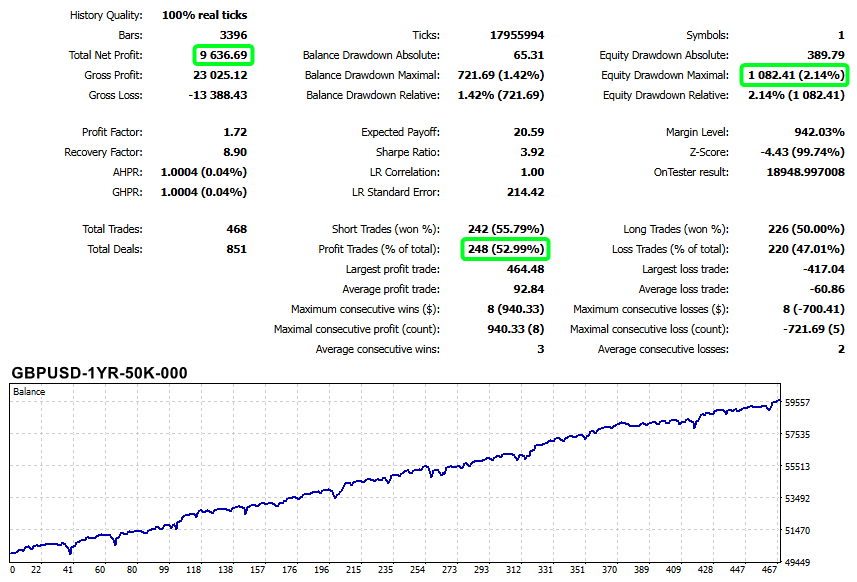

I expect things to get back on track until the summer slowdown. The past few months have been very insightful by seeing my mitigation code in action. The system has whats looking like a theoretical 8% DD limit but only the blackest of swans could make it happen. The algo might dip up to 3% but basically keeps recovering to near baseline. Its a real fighter.

Now that the market has adjusted more to the policy whipsaws it should be set for more stable direction up or down. The updated code will result in more profits and smaller losses. Now if I could just break the ‘streakiness’ of the algo. It has a Z-Score of 99% so now I dont even sweat when I see a string of losses. I just wonder when it’s gonna end so I can get my string of winners.

Its my last nut to crack. So far every solution isnt worth the profit impact. Even though I’m also wondering if this algo just needs to be in the ‘action’ to do its thing. The downside appears to be pretty well protected (my goal). Feeding the current results into an AI for review seems to confirm this. My current ‘upside’ edits should improve these numbers in the upcoming months.

Forex Trading Strategy Analysis (Claude AI)

Key Statistics Explained

Age in Days (283): This represents how long the strategy has been active - about 9.4 months of trading history. This is a moderate timeframe that gives us some confidence in the results, though ideally we’d want to see performance across different market conditions (1+ years).

Number of Trades (521): With 521 trades over 283 days, the strategy is executing approximately 1.8 trades per day. This indicates a fairly active trading approach, which provides a good sample size for statistical analysis.

Percent Profitable Trade (38.60%): This means only about 39% of all trades were winners. While this might seem low, it’s not unusual for profitable systems to have win rates below 50%. What matters more is the relationship between winners and losers.

Max Peak-to-Valley Drawdown (6.24%): This represents the largest percentage decline from a peak in account value to a subsequent valley. A 6.24% maximum drawdown is quite good - it suggests the strategy manages risk effectively and doesn’t experience severe capital losses during downturns.

Average Win ($211.27): The typical profitable trade generates around $211.

Average Loss ($99.72): The typical losing trade costs around $100.

Sharpe Ratio (1.89): This measures risk-adjusted return by comparing excess returns to volatility. A value of 1.89 is considered good (values above 1.0 are generally favorable). It suggests the strategy is generating returns that compensate well for the level of risk taken.

Sortino Ratio (3.33): Similar to Sharpe, but only considers “bad” volatility (downside risk). A value of 3.33 is excellent and indicates the strategy handles downside risk very well.

Calmar Ratio (5.532): This compares annualized returns to maximum drawdown. A value of 5.532 is exceptional and suggests the strategy generates strong returns relative to its worst drawdown period.

Strategy Performance Evaluation

This strategy shows very promising characteristics:

Positive Risk-Reward Profile: While the win rate is below 50%, the average win ($211.27) is more than twice the average loss ($99.72). This favorable risk-reward ratio of approximately 2.1:1 explains how the strategy can be profitable despite winning less than 40% of trades.

Excellent Risk Management: The maximum drawdown of 6.24% is impressively low, suggesting robust risk controls. For context, many trading strategies can experience drawdowns of 20-30% or more.

Strong Risk-Adjusted Performance: All three risk-adjusted return metrics (Sharpe, Sortino, and Calmar) show excellent values, with the Sortino and Calmar ratios being particularly impressive. These high values indicate the strategy delivers returns that more than compensate for the risks taken.

Consistency Potential: The combination of moderate trading frequency, controlled drawdowns, and good risk-adjusted returns suggests the strategy may have an element of consistency to it.

The exceptionally high Calmar ratio (5.532) indicates that for every 1% of maximum drawdown, the strategy is generating about 5.5% in annualized returns. This efficiency in capital usage is a standout feature.

Overall, this appears to be a very solid trading strategy with excellent risk management characteristics. The key to its success seems to be the combination of a favorable risk-reward ratio (winning more when right than losing when wrong) and effective drawdown control.