The previous thread for this strategy is here.

50% off first three billing cycles coupon (good through end of Feb): UGBD28459

And as always, ANY CALENDAR MONTH THIS STRATEGY DOES NOT RETURN POSITIVE ROI (as reported by C2) CURRENT SUBSCRIBERS WILL GET THEIR NEXT MONTH FREE.

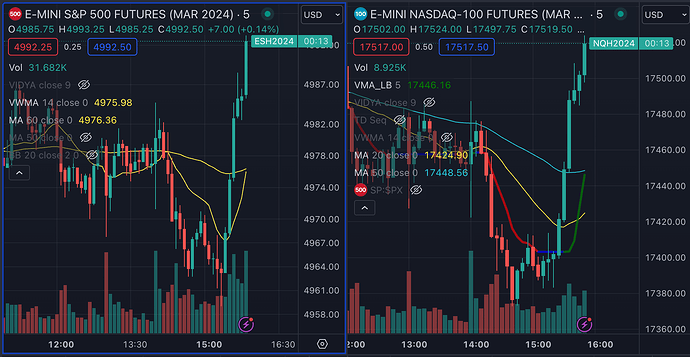

Like the S&P 500, SP 500 Futures Scalper closed at a new all time high yesterday, more than recouping the losses suffered in September and October.

For anyone not following along over the last few months, I technically started this portfolio of strategies on C2 at the end of January 2023, spent February working out some “nuances” with C2’s BrokerTransmit system to broadcast live trades, and really got going in March 2023.

We were green every month from March through August, but we took a hit in September and October (along with the rest of the market). On the backend, we realized that our strategies, which are automatically tuned over every weekend, became “over-tuned”, or overly biased toward opening and holding long positions, since that was paying off for the first few months it ran. However, when the market jumped off a cliff in September, that long bias ate our lunch.

We spent most of October retooling our strategy selection and tuning process, and made a number of important changes, including significantly tightening our stop loss and take profit calculations, and splitting out our strategies into “long only” and “short only” strategies, reducing the impact of a sharp market reversal against our net open position.

The goal of these changes was to “even out” the roller coaster a bit, tempering both the potential downside AND upside, targeting a consistent positive monthly (or at least quarterly) return with less correlation to market behavior, rather than our ROI basically just magnifying the current market direction.

Since “re-launching” in November, while positive every month, we actually slightly trailed the insane end-of-year bull run when the market bounced back from the Sept/Oct pullback. And we’re OK with that, because what we saw was exactly what we hoped: we took measured profits in good market weeks, and either added profits or minimized losses in red market weeks.

About the strategy:

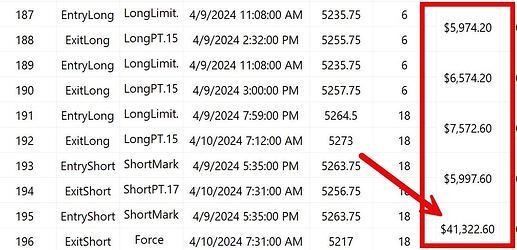

SP 500 Futures Scalper opens long and short positions in futures markets trading S&P 500 E-Mini and Micro E-Mini futures contracts. It is designed for account balances of at least USD$60,000. The maximum position is three E-Mini contracts (or thirty Micro E-Mini contracts).

-

I trade this strategy live in my own Interactive Brokers account. Every trade is posted using C2 BrokerTransmit, and is a trade I have executed. What you trade, I trade.

-

On the backend, this strategy is actually a collection of independent “long only” and “short only” strategies. So C2’s BrokerTransmit system does not break, long positions trade Micro E-Mini contracts, and short positions trade E-Mini contracts.

-

This strategy is AI generated and tuned weekly (over the weekend).

-

This strategy is 100% automated and run 24x5. I NEVER place a manual order, or override an automated order.

-

My tuning and trading servers are beefy dedicated physical servers (not virtual machines) sitting in a data center in New Jersey with <2ms latency to Interactive Brokers. I’m not running this out of my basement or off of my laptop.

-

Collective2 is not my full-time gig, but automated algorithmic trading has been my full-time gig for the last six years.

This strategy was generated using genetic algorithm AI and opens a position only when a convergence of technical indicator values result in an acceptable trade setup, and then calculates aggressive take profit exits, ideal for volatile markets with frequent sentiment-driven intraday reversals that destroy most day-trading strategies. The manager has traded this strategy live since May 2022 with their own funds through their broker.

ALL RECORDED TRADES IN TRADE RECORD ARE LIVE TRADES IN THE MANAGER’S OWN ACCOUNT. In other words, I’m trading MY money with this strategy, not just yours. C2 trade signals are generated by mirroring the trades in my live Interactive Brokers account.