I’ve been trading two strategies here for a few months now, and they are both doing quite well. Both strategies show a red Jan/Feb while I was trying to figure out C2 nuances to get my strats running smoothly here, but all green since C2 BrokerTransmit kinks worked out from the beginning of March.

I haven’t really advertised them or solicited subscribers until now simply because a) I was building a track record, and b) I wanted to see if these simplified versions of what we run in real life for our clients would do well. Turns out they do.

A couple of things to know:

-

I trade these strategies live in my own Interactive Brokers accounts. Every trade is posted using C2 BrokerTransmit, and is a trade I have executed. What you trade, I trade.

-

These strategies are AI generated and tuned weekly (over the weekend).

-

These strategies are 100% automated and run 24x5. I NEVER place a manual order, or override an automated order.

-

My tuning and trading servers are beefy dedicated physical servers (not virtual machines) sitting in a data center in New Jersey with <2ms latency to Interactive Brokers. I’m not running this out of my basement or off of my laptop.

-

Collective2 is not my full-time gig, but automated algorithmic trading has been my full-time gig for the last five years.

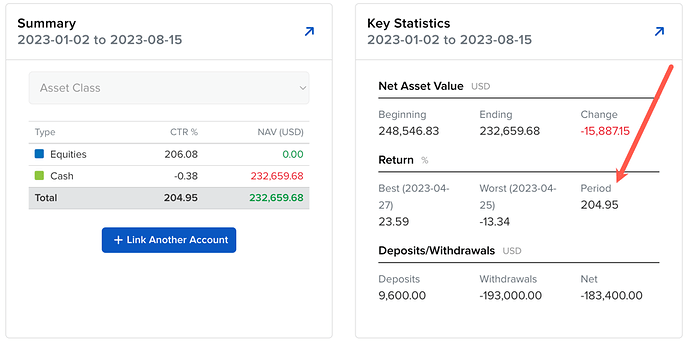

The stats I’m sharing below are from the beginning of March (after getting BrokerTransmit running smoothly).

- Instrument Traded: S&P 500 E-Mini and Micro E-Mini futures contracts

- Position Direction: Long and Short

- Intended Position Size: Up to one E-Mini and ten Micro E-Mini contracts per $50K balance

- Suggested Minimum Capital: $50K (no idea why C2 says $70K, as MAXIMUM balance/margin required at the broker, including drawdowns, has actually been just over $30K)

- Order types: Market orders to enter a position, Limit/Stop orders to exit

- Win Rate: 88.3%

- LIVE ROI since March 2023: 50.2% (9.2%/month average)

- Return since March 2023: $29,582

- Max Portfolio Drawdown since March 2023: 8.8% (in March)

- Identical S&P 500 E-Mini and Micro E-Mini trades as above, but also trades NASDAQ E-Mini contracts.

- Intended Position Size: Up to one S&P E-Mini, ten S&P Micro E-Mini, and one NASDAQ E-Mini contracts per $100K balance

- Suggested Minimum Capital: $100K

- Order types: Market orders to enter a position, Limit/Stop orders to exit

- Win Rate: 91.1%

- LIVE ROI since March 2023: 49.5% (9.1%/month average)

- Return since March 2023: $54,957

- Max Portfolio Drawdown since March 2023: 12.2% (in April)

Both of these strategies are priced significantly higher than most strats here on C2. I’m not interested in a ton of subscribers, I’m interested in the right subscribers. If you wouldn’t (or can’t) spend $500-$750/month to average $9K+ a month ROI, then these aren’t the right strats for you, and candidly, you’re not the right subscriber for me. I have a full time job working with clients trading eight figures on more complex versions of these same strategies, so I’m not going to spend a lot of time here convincing someone to subscribe. Any income generated here at C2 through subscriptions just goes toward my infrastructure expenses.

The following coupons are a 50% discount for new subscribers for your first two billing cycles, and are valid through September 10, 2023:

SP 500 Futures Scalper: UGNV58486

SP500/NASDAQ Scalper: UGJD96622

Lastly, ANY month that a strategy you are subscribed to does not return a positive ROI as reported by C2, you will receive a coupon for your next month free.

Thanks in advance for your consideration, have a great day.