@MatthewKlein, how can we protect users from wealth destruction? With all the machine learning at your disposal… is there a way to find early flags?

hmm…it’s really weird.

Hi,

Leverage > 30 is very dangerous. That would be the biggest alarm signal for me!

My suggestions are in the video below. In short, I agree with @Fabi.

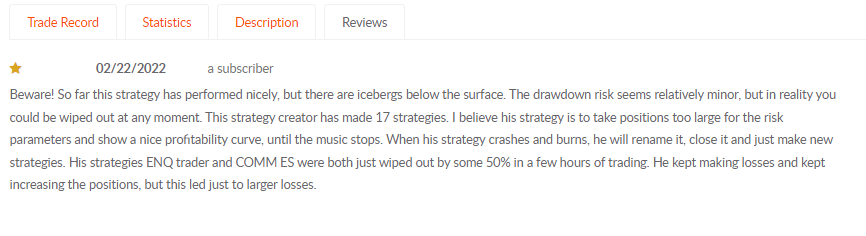

The above review of Dow Jones Long nicely sums its up. And the review was in February of 2022 before a nice run up for the strategy.

C2 investors can and should instruct their broker (and/or their Trading Station) to liquidate any position when its drawdown reaches a certain level, say 10%.

This is the only way to protect their account from catastrophic losses.

Depends on how C2 wants their bread buttered:

A good start would be by giving visibility to all strategies a manager has currently open and those previously closed (with subscribers at one point). That way a potential subscriber can make an informed decision on going with this type of manager.

C2 should also rank managers considering all their strategies - good ones and blown-up /closed down strategies.

And you sincerely believe that this will prevent C2 investors from blowing up their auto-trade account?

Trade Leaders who create multiple accounts represent maybe 1 or 2% of the total C2 community.

That means 98 to 99% of all the catastrophic losses will come from NEW, fresh C2 trade leaders with poor or no money management skills.

And unless C2 investors take charge and limit their losses in their own account (as explained above), they will continue to experience spectacular and devastating losses if the trade leader they are following is a bad trader with a gambling mentality.

For a subscriber, you can set up your own Auto Stop Loss in your autotrade Control Panel, any amount ( for exmple $1000-5000) can be entered. This stop-loss order goes to your broker’s server for every trade and it stays there until the trade is offset. Also, this order overrides the Trade Leader’s, so is like a safety net. To protect your equity, you might want to look into it.

None of these systems were TOS. Just sayin…

@MatthewKlein can you please comment on whether the auto stop loss approach mentioned above would have helped limit losses following the catastrophic losses in the mentioned strategies? Thank you