Maybe C2’s model is working great for them but squeezing us on fees and subscribers on C2 wanting high double digit returns or triple digit combined with single digit drawdowns is extremely stressful. I have done this though so far and have had over 120 subscribers but can the majority of the leaders be expected to live up to this? You and I have done pretty amazing and honestly should be charging $195 a month and have 200 subs but that’s not the case because of expectations that are unique to C2 for some reason.

Matthew you really should consider reducing fees. I mean leaders do it, so can you.

120 subscribers paying $50 (your portion of the subscription fee) is $6000 a month or $72,000 a year. If you were to get TOS certified your pay would jump to $86,400. That’s on top of your regular job and any profits from your own trading.

Making nearly $100k a year at a part time gig without needing the usual government certifications, worrying about the website technicalities, collecting payments, or attracting a critical mass of subscribers seems like a great deal to me.

I’ve had over 120, had a great spike when I was featured strategy of the week, that has dropped to about 60 and many came with a hard court press of offering $30-$60 coupons. I mean I marketed the hell out of it. Needless to say half the budget buyers dropped off even after making thousands.

I’ve made many thousands but like was said earlier subscribers are making much more. This poor guy has only cleared $400 and he’s doing great. So the lesson is if you don’t maintain a single digit or near single digit drawdown and don’t return over 80% you are going to work very hard and maybe only have 5-10 subs. Even a 5% reduction would be welcomed or some kind of restructuring.

Or perhaps you lost a lot of subs because once you were featured you decided to drastically raise your price or that the strategy has made only 5% over the last 3 months. I’ve kept my price the same, had steady gains and I’ve had a net gain in subs every month, despite your forum posts telling my subs that they should quit. My subs know a small price increase is coming, but it won’t be a 6x increase like this strategy.

Everyone knows the pay rates when they start, and there are ways to increase that rate (TOS, C2Star) if you choose. To me this is easy extra money for doing something that I already do (trading my personal account) without much effort.

I am certainly not complaining and very grateful for the services that C2 provides. All I am saying is that in the current state of it all I expect to make more money from my actual trading than from subs on C2 and don’t expect that to change anytime soon. However C2 still provides great services to me by providing a public track record and making it easier for me to automate my orders to Interactive Brokers. C2 is way less work than starting a firm and taking on clients but I think if one wants to make big bucks managing money for others they need to start or work for a firm etc. When I have raised my prices I have always locked it in for existing subs for lengthy periods of time so I haven’t heard any complaints from them on prices.

I’m not going to argue with a rat like you, you forget how you initially attacked me several months ago on my thread, and yet again several days ago. Telling everyone I would fail miserably. I understand you were envious and wanted to make a name for yourself.

I never raised my prices 600% I was making $139 for awhile and went as high as $200 or so but then reduced my price to $95.

My subscribers get upset when I get too aggressive, they pm. saying slow and steady wins the race. I have a TON of 5 star reviews.

C2 is great and I’m thankful for the nearly 40k I’ve made so far.

So stop your constant insecure attacks.

@ETFCapital and @EthosPortfolio I think you both have had fantastic results, and I wish you both the best of luck. But I am going to bow out of this thread and perhaps the whole forum for a while if I can get myself to stick to it. I find the forums addicting. I appreciate the advice and suggestion from both of you and the others that have commented on the thread. I know that my methods can appear odd at times but like most people I am just doing the best I can.

@InteractiveAssets…I may not be Dr. Fauci but social distancing from the forums sounds like a great idea!

You might as well, the forum neither helps you or loses you subscribers. I wouldn’t worry too much about it though.

Just to clarify, in the post you referenced a number of forum members pointed out a number of abandoned strategies that appeared to be yours and how martingaling systems always eventually fail. Since then, as you stated, you’ve become less aggressive and have stopped martingaling. Your strategy now looks much more sustainable than it did back then.

I congratulate you on the ability to switch trading styles and still be profitable. That’s a feat that most traders could not pull off.

As always, I wish nothing but the best for your subscribers.

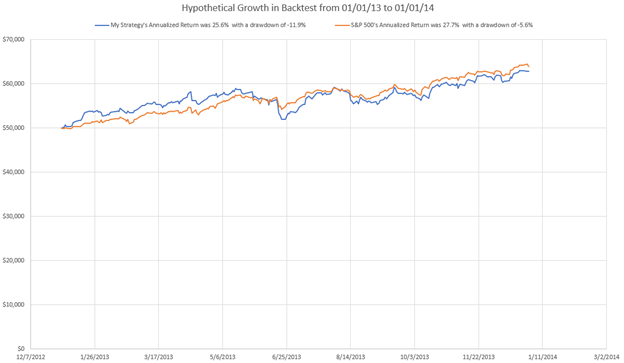

DETAILED BACKTEST RESULTS

I hope you are all well and about to have a great Easter weekend. Today, I wanted to take a little time to give a more detailed look at my backtests. You must realize that these are just estimates of hypothetical performance and not guaranteed to be correct. My main reason for doing this is to show you that my performance will not always be as good as it is at this moment. There are major risks to investing the way I do. I likely have not done my backtests with perfect accuracy. There may be some major problems I am missing. I do feel very confident that my strategy at some point in the future will have a drawdown much greater than has today and likely larger than any of the backtests show because the past is not a guarantee of the future. Bottom line invest at your own risk! I am investing my own money at my own risk.

New Backtests

It is difficult to know if a system will perform in the future like backtests showed in the past. There is no way to guarantee the future. However, it is possible to test the quality of the backtesting methods to a degree by trading with real money for a period and then applying the exact same backtesting methods to that period. By comparing the results, it can help show if the backtesting methods seem to even reflect reality.

I started trading live with a significant portion of money on June 4th, 2019 through April 1st, 2020. Last weekend I also performed backtests for that period to compare the backtests to the actual results. The results were very similar and make me believe that for the most part my backtesting methods do provide a good general idea of how my strategy would have performed in different periods in the past.

There are of course many limitation to my backtesting the further back in time I go because not all the data for those periods are availablse and some of the assets I trade didn’t even exist back then. But I have done my best to work around those. The results assume I did not speculate on Bitcoin until GBTC was publicly traded.

Below is a summary comparing the hypothetical C2 results vs my backtest results:

Longer Term Backtests

In my mind the effectiveness of my backtesting is confirmed though as always there are still big risks and uncertainties. Now more than ever I believe my backtesting methods seem to be able to mimic history. My test seem to show that:

- Some years it shows results worse than the S&P 500.

- Some years it shows negative or flat results

- Down years in the market seem to be good for my system.

- The system does best in trending markets.

- Really good years and really bad years for the strategy can occur in any order.

I am using the following graphs to give myself an idea of the good, the bad, and the ugly I need to be able to stomach when trading my strategy. I believe consistency is key for any subscriber to have a chance of mimicking my strategy well.

Have a good Easter and enjoy the graphs below!

Interactive Assets

YTD

Full Time Frame

Personally, I don’t have the knowledge or experience to evaluate your backtest parameters, method, or validity… but… it does appear you’ve made a serious effort to fully disclose your strategy strengths and weaknesses, and if I’m correct in that assumption, I wish you the very best of luck on C2. I think honesty and integrity pays long term dividends.

I also like your year-by-year results, as they tell a more meaningful story than a single long term chart. It lets me visualize each year vs the S&P results.

Have a good Easter!

Perhaps the most common questions I get are “can I have a free trial” or “can I have a discount for 1 year?” So I want to address both of those items really quick. First please don’t take this personal but the short answer for both questions is unfortunately “No.” I hope my reasoning below helps you understand why.

Can I have a 1 year discount or other long term discount?

The ease of getting set up at C2 is a huge blessing. However, there are certain limitations that come with that, such as not being able to give personalized investment advice legally or refund fees based on performance. Sorry those are the rules.

Because of this I don’t ever want to know how much or how little you intend to copy my strategy with. Since my fee is a flat fee the pricing for various scenarios could be ridiculously expensive or ridiculously cheap. I like to think of subscription fees and AutoTrade fees as one annual fee even though they are not technically. Currently C2 has $15,000 listed as my suggested minimum capital. Therefore, to me the worst case scenario for an annual fee is someone following with the minimum and paying 14% the first year.

That is huge compared to an index fund, and in years when I lose money it sure won’t feel like it was worth it and could go up for the individual if the account goes down. However, on good years like this one where my performance (SO FAR) has been 105% the 14% fee is relatively small.

So the annual fee can vary but that is out of my control. However, investing just $30,000 drops the annual fee to about 7%. Investing in my strategy is very risky. It certainly wouldn’t be suitable for people that don’t have plenty of high risk capital to throw around, making my fee rather small to anyone investing larger amounts. If there was a way for me to keep the fee at 2% for anyone investing small amounts I would but there is no legal way for me to do that.

Finally and most obviously, I want C2 to be well worth my time and money too.

Can I have a free trial?

I have not found that free trials do a great job of converting people to subscribers. Furthermore, there is not much you will learn from a 1 month free trial from me that you cannot find in this extensive thread or in the description of the portfolio. Many months I don’t even have a trade. However, one thing you would learn from a free trial is that every trading day my stops are updated. So most days the only trade info that changes on my strategies is the location of my stops. Alerts for those can be turned on or off in your C2 settings.

Unless I am mistaken, the fees are already included in your C2 return of investment, so that shouldn’t be a problem for your subscribers, money-wise (assuming you continue to deliver that kind of positive ROI), yes?

I agree with your assessment. I used to give an automatic half off to anyone who asked or who simmed. It’s a good promotion for new strategies to attract followers. But once a strategy is established there is no need. I’ve completely stopped giving discounts as well. Funny thing is, almost every potential subscriber who asked for a discount ended up subscribing at full price even after I said no.

I strongly believe that if people are serious about making money they will gladly pay the required subscriber fee, no matter what the price is. You can charge $1 000 a month (some C2 trade leaders do) and you will still find takers, if they see that your system can make them money in the long run.

Higher subscription fees also tend to attract “high rollers”, people with deep pockets who want a least twice the average annual return of the S&P 500.

Deliver and they will come, that’s all there is to it.

Keep up the good work.

Patience is a Virtue is celebrating 12 full months of publishing on Collective2. The last few months it has underperformed the market, but that is to be expected at times. Matter of fact it did worst than the market for about 6 months last year, but when in doubt I zoom out. If this month is hard I zoom out and look at the last year. If this next year is hard I will zoom out and look at my previous year and backtests.

The last couple months have not been great for me, but I have not changed my system it has simply been one of those time periods where my system doesn’t do as well. Obviously I am always looking for ways to improve it and am always checking for reasons or evidence that my system no longer works. So far I have not come close to any reason to abandon my strategy. It is simply a natural period were it hasn’t done as well. As I have said time and time again many months and years my system will under-perform the market, but according to my backtests I just need to keep calm and carry on.

I am very happy to currently have $1.6 million following my strategy (including my own money) and I hope to have much more soon. I encourage you to check out my strategy description and my backtests to see if my strategy is a good fit for you.

Today marks one year for Patience is a Virtue!

It is crazy to think that when I first posted in this thread my strategy looked like this:

But now it looks like this:

Check out the strategy! From what I found it is one of only two strategies to appear on both the IRA Friendly and Trades-Own-System Leader Boards.

Happy Anniversary to your trading system then! ![]()

Very nice returns! And still alive after one year  And besides the returns, I like the other statistics as well. Good trading!

And besides the returns, I like the other statistics as well. Good trading!