Again, where did you get that idea?

Just check all the systems that go to zero and check their win rates. It’s usually over 80%. Just Forex had over 90%. These traders don’t close losing positions and even add to them. In slow moving markets like many currency markets often are, this can give a good return for a long time but when a really big move comes the system goes bust. Low win rate systems close losing positions before they become too big.

If there are 2 systems with 50% annual returns and max drawdowns of 30%. One has win rate of 50%, the other of 85%. Which one do you think is going to do better and which one is more likely to exceed their max drawdown?

I wasn’t debating you just stating what I notice, virtually every position with 1 open share was in the red and in my opinion this was done intentionally with malice. Your explanations seem absurd.

I agree with you up to a certain point. If we look at the most successful and biggest hedge funds for example, especially the trend-following ones, we notice that their winning percentage rarely exceeds 40%.

That means they make hundreds of millions per year (for themselves and their customers) while still losing 60% of the time!

However, a system with a low wining percentage is certainly not a guarantee of profitability, far from it. There are hundreds of LOSING trading systems that win 30% of the time (or less).

Cordially.

Hi, I used your coupon to check the trades. I see that you had a ZIV trade last year that had a drawdown that was 17.95% of total equity. Was this position hedged by some other position the system held at the same time. 17.95% on just one trade seems a bit risky. What’s the max loss the system would let a single position go to before you close it?

I agree with you up to a certain point. If we look at the most successful and biggest hedge funds for example, especially the trend-following ones, we notice that their winning percentage rarely exceeds 40%.

That means they make hundreds of millions per year (for themselves and their customers) while still losing 60% of the time!

However, a system with a low wining percentage is certainly not a guarantee of profitability, far from it. There are hundreds of LOSING trading systems that win 30% of the time (or less).

Cordially.

Yes of course a low win rate doesn’t imply a good system. More important indicators are return / risk ratio, consistent results, sharpe ratio… etc… On the other hand an overly high win rate could signal a risky system.

Technically the max loss for my positions would be the cost basis of it. I do set a 35% stop loss each day based on the closing price of each position. It can move up or down over time. I only use it to catch large single day drops not drop that occur over several days or weeks. I use my signals for that.

I always have a mixture of assets at a given time so when one asset is doing poorly another tends to be doing well. In that sense I think more like an investor balancing a tradition portfolio and less like a trader trying to time everything perfectly.

I don’t recall what assets I was holding at the time of that drawdown in ZIV but I am sure ZIV was just one asset out of a handful of others. Just out of curiosity does this answer concern you?

Sorry you find it absurd. I can promise you that I intend no “malice.”

I do set a 35% stop loss each day

You mean your are willing to lose 35% of your capital on a single trade?

@LiveForexSignals To be clear it is 35% of trade value not total portfolio value that the stop is set at.

Yes I am okay with one or several of my positions losing 35% in a single day. However, I never own just one position and usually own other positions that would go up while one dropped. I think of it like I would a balanced or target date retirement fund. Some positions within the fund will go up but others will likely go down.

Technically the max loss for my positions would be the cost basis of it. I do set a 35% stop loss each day based on the closing price of each position. It can move up or down over time. I only use it to catch large single day drops not drop that occur over several days or weeks. I use my signals for that.

I always have a mixture of assets at a given time so when one asset is doing poorly another tends to be doing well. In that sense I think more like an investor balancing a tradition portfolio and less like a trader trying to time everything perfectly.

I don’t recall what assets I was holding at the time of that drawdown in ZIV but I am sure ZIV was just one asset out of a handful of others. Just out of curiosity does this answer concern you?

Generally I think if a system loses a high % of system equity on just 1 trade (over 10%) then that’s not such a good sign. That can lead to big drawdowns. The exception is if that trade was hedged by another one that was negatively correlated. Looking again at your results it says that the max drawdown for the ZIV trade was on 20 March 2020. You also opened a position in TVIX on 13 March so that hedged the ZIV position as TVIX moves in the opposite direction but more faster.

TVIX is long vol, ZIV is short Vol. What is the idea behind holding them at the same time?

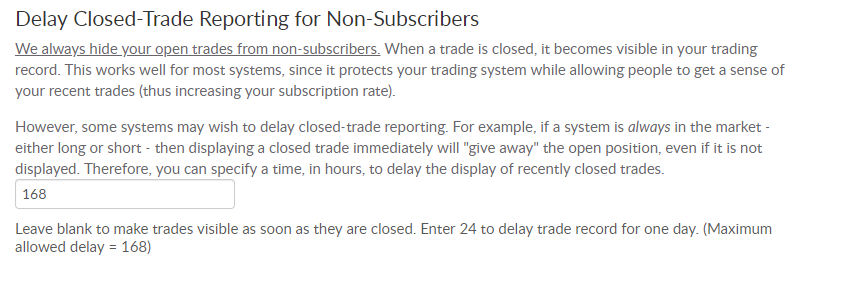

I believe if you look at it I only had 1 share of ZIV at the time which I was doing at the time because I was trying to keep my trade record private from people who were not paying the subscription fee. However, now I am just using the “Delay Closed-Trade Reporting for Non-Subscribers” feature and calling it private enough. I can think of no situation where I would intentionally hold a significant portion of ZIV and TVIX at the same time. However, I could see a scenario where I held a mix of TVIX and a 3 times stock ETF.

Edit: Turns out this trade drawdown was wrong and was updated later. For more details check out this visit this thread: Can you Double Check My Drawdown?

Actually other than these discrepancies your system looks great and well diversified. Keep it up. I’m just worried about C2 if everyone joins for $20 and quits the rest, they’ll go out of business.

That is very kind of you! I certainly won’t keep it that low forever. I definitely want to see C2 succeed long term and want to make more money for myself.

The best way to do that is to grandfather existing subs and raise for new subs. Keeps your base happy.

OVERVIEW OF REAL RESULTS AND BACKTEST RESULTS FOR PATIENCE IS A VIRTUE (PIAV)

In this post I want to answer

- What are the high and low level expectations I have for PIAV?

- What do tests show?

- How long have I been trading like this?

- What are my real results prior to Patience is a Virtue?

1. Expectations

After a sharp run up like PIAV has experienced it is easy for myself and for subs to think they will continue. This is not going to happen. The numbers I am about to give are not guaranteed or verified. They are only estimates I have made for myself using backtesting and real trading tests. I expect long term returns to be somewhere in the range of 30% to 45% annualized with drawdowns in the range of 20% to 40%.

2. Test Results

Some parts of my strategy can only be backtested back for about a decade while others can be backtested as far back as nearly a century. The period I find the most telling to backtest is 2007 through 2019. Below you can see two charts showing my hypothetical results in blue vs the market in orange. One chart is on a logarithmic scale so that the details of the 2008 recession can be seen.

3. How long have I been doing this?

For about 5 years I have had a hobby of taking old market data and running simulations to see if I could find a way to beat the S&P 500. I have had C2 strategies at various points in the timeline but never something like Patience is a Virtue. All previous strategies are private, and that is how I want to keep them. Sorry. My overall timeline is as follows:

-

January 2015 started testing items but never found any success with individual stocks and options.

-

Mid-2017 began trading volatility products. I had great returns and definitely got too confident that things would continue. Fortunately, I was out of XIV when it crashed because my indicators told me to get out. This gave me confidence in my volatility indicators just like the recent TVIX gains have. However, I struggled to find an overall strategy that actually felt comfortable to use for the majority of my net worth. This is why I had kept all my volatility positions as a small percentage of my net worth to avoid catastrophe.

-

February 2019, I began finding some promising results of how I could combine my volatility trading with several other strategies across multiple asset types including stocks, bonds, precious metals, and crypto.

-

From February 2019 through May 2019 I used small amount of money to place real trades. At the end of May 2019 I ran backtests for February 2019 through May 2019 and compared them to the real results. The results were not identical but pretty darn close.

-

June 2019, I began trading my overall strategy with the full balance of my brokerage accounts and set up my C2 strategy PIAV. I felt comfortable doing this because I had done Initial backtest for long periods of history, done small amounts of real money investing, compared the real money against new backtests over the same period, and finally checked it all with reason and logic. By my logic there are perfectly valid reasons why my strategies work and will likely continue to work far into the future.

4. Previous Results

The chart below shows me (in blue) vs. three measures of the stock market. As you can see my results since June when I started Patience is a Virtue have paid off for the years of research and low returns.

As you can see I never blew up my account but never did great until starting my strategy in June. This is because I never put too much money into the things I was testing until June. You may be tempted to think that I am only getting lucky and doing well because of the downturn. This could be true. However, from June 2019 until the peak of the market I also had good returns as you can see below. Finally as I mentioned earlier, I have had C2 strategies at various points in the timeline but never something like Patience is a Virtue. All previous strategies are private, and that is how I want to keep them. Sorry.

Thanks for this explanation and congratulations on your current success! It’s very impressive how your system is working in this bear market so far. You certainly have managed your trades very well lately. I don’t put a lot of faith in backtests, especially if they don’t show trade-by-trade results. After all, backtests don’t experience margin calls and other negative things that happen in real-life trading but I like that you show all the versions of your system. I do appreciate your honesty.

Have you considered using the indicators from previous incarnations of your system, maybe the one with the green line on the chart, during bull markets and then switching to your current incarnation during bear markets? Or working to develop an even better one for bull markets? Since you interpret volatility so well, it seems you have the ability to tell when we are in each type of market pretty quickly.

For instance, even though we don’t see it on the chart, you say your current system also did well during the GFC and in the chart above it seems it may have lost less than the other incarnations during the correction at the end of 2018.

A lot of systems on C2 that were doing well for many years have blown up now because they are still using indicators that worked in the old market. It’s a new market now, with more volatility than we have seen in years. Imagine if you could figure out a way to profit during times of low volatility (hope we get than evironment back, soon).

I don’t put a lot of faith in backtests, especially if they don’t show trade-by-trade results.

I don’t blame you. I too don’t put a lot of faith in them alone. I do have trade by trade results but don’t wish to share them.

I like that you show all the versions of your system…

I have added more text to the post and left it in bold. I think we are miscommunicating on some of the charts. Please see the bold for clarification.

Imagine if you could figure out a way to profit during times of low volatility

I believe we are not on the same page with the the charts so. My backtests indicate decent results during high and low volatility. Choppy markets and turning points are where it does the worst. As you can see below I think my strategy did fairly well when we had low volatility while my strategy was live. The primary cause of the drawdown if I remember correctly was large GBTC drawdowns which am working on improving with further backtests and testing elswhere. Though I have not found any great solution yet.

No matter why you don’t show your backtest trades, it’s still a big question mark, no getting around that. I don’t think you are being dishonest about the results though, I hope that was not how you interpreted my statement, you have always been honest and forthcoming as far as I can tell.

When multiple positions are held at the same time, there is no way without seeing the trades to gauge what kind of drawdowns occurred in individual trades. There is no way to see if the fills are realistic, to know what you were trading and how liquid the instrument is. And, as I said above, no way to see if a margin call would have been generated in real life.

Oh, OK, thanks for the added legend on that first chart, completely different message with that information. Right before the chart you spoke about your previous incarnations of the system, so seeing a chart with no legend led one to think that was a chart of other versions.

I don’t come to C2 looking for systems like yours that get “decent” results during a bull market. Monthly fees are lot of money to spend to not see your money grow. I get that you are a Patient guy but you have to admit, your surge of subscibers came when your equity curve shot up. How many did you have while you had “decent” returns? How many will you maintain when you go back to “decent?”

My suggestion of adapting your system for bull markets was meant to be helpful.

Definitely didn’t take it as you calling be as dishonest, which I appreciate. Yes my individual trades have larger drawdowns than most “traders” would allow but well within okay in my opinion for a trader/investor hybrid. (I simply mean that an invest in a mix of bonds and stocks in a mutual fund would not concern themselves with the drawdown of individual types of bonds within the mutual fund if the mutual fund overal is acheiving its goals. Later the fund will likely rebalance and the bonds will do much better etc. )

I agree with you most don’t come for decent results however to me C2 is the only place that 40% annualized would be considered only decent. The fees are high and most subs did not come until this surge and most will likely quite as soon as my next drawdown. I did an analysis of the top earners on C2 and I estimate they make far less in subscription fees compared to trade profits. In total I have netted approximately $400 in subscription fees after the C2 cut and discounts I have given people. That obviously pales in comparison to the results of my trading in the account that gives me TOS status alone. Then if you include the other accounts I use it is even more dramatic. Which is a good reminder that I should probably spend less time on the forums and less time answering subs questions. The cost benefit just isn’t great. It would be better for me to spend my time doing other things or improving my system.

I appreciated your comments. I just wanted to make sure we were on the same page.