So, I’m fairly surprised by how often I get asked (either in the forum or via DM) some flavor of the question “why don’t you just publish a strategy (or change your current strategy) so that it consistently makes money, but without the big drawdowns (or with tight stop losses, same thing)?”

So, when you read that question objectively, you probably realize how silly that question is. In case you don’t, here is my response: “If I had a strategy that worked with C2’s framework and consistently makes money WITHOUT the periodic large drawdown, DON’T YOU THINK I’D BE PUBLISHING THAT INSTEAD?!”

Now, in my non-C2 life, we DO run a strategy that is something along those lines: a scalping strategy with a TIGHT take profit target (like 6-8 ticks) and a TIGHT stop loss (around 26 ticks I believe). It places a limit entry order that, when filled, immediately triggers an OCO order with the take profit Limit order exit as well as the Stop Loss exit Stop order. And this strategy actually does pretty well, usually holding an open position for no more than a few minutes (and often less than a minute). However, with that TIGHT take profit target, while it may work for us, there is NO WAY it will work within C2’s framework (which they are very clear about, and correctly so). Regardless of what order types I place in our IB accounts, C2 only broadcasts executed trades, and then only as market orders to subscribers. A subscriber would get murdered executing those trades as market orders, AND a few seconds later.

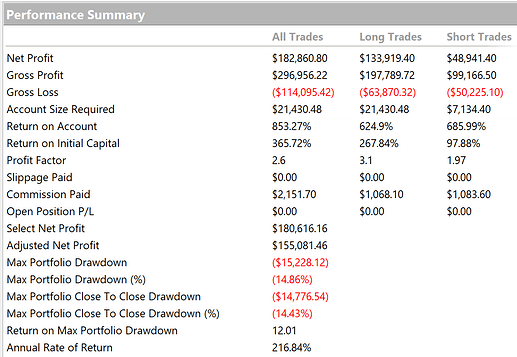

So, how does our current strategy here on C2 perform if we place tighter stop losses on the trades? Here’s the answer, backtested for 2023 with various Stop Loss levels:

The bottom line is, for these strategies, DOUBLE DIGIT DRAWDOWNS are part of it. I understand if that’s not your thing, NO ONE likes going through it, including myself. If you don’t have the stomach for that, that’s OK, and the answer is simple: DON’T SUBSCRIBE. But there is a reason I trade these strategies live in my personal accounts, as well more complex versions for clients trading WAY more than is reflected here: THE FUNDS WE HAVE ALLOCATED TO THESE STRATEGIES ARE OUR HIGH RISK/REWARD ALLOCATION, AND TO DATE QUARTER OVER QUARTER, THEY HANDILY BEAT THE MARKET.

Believe me, when we come up with a 100% automated strategy that has great returns AND has minimal drawdowns, AND that works within C2’s framework, I’ll be publishing it and advertising it to the moon. There may be other strategies here on C2 that already meet those criteria, and if so, let me know so I can subscribe!

But until then, I’m offering what I’m offering: a 100% automated strategy with a (so far) outsized return for the periodic double digit drawdown. PLEASE stop asking for tighter stop losses, a “better” strategy, etc. Our clients have prioritized ROI/MaxDD and are OK with the occasional double digit drawdown. If you’re going to subscribe, you need to be too.