Hi, C2 Family I’ve been away grinding on a new system. My original system driving this account trades similarly to human traders and needs trader volume and momentum so it kinda flatlines during the dull summer months on low-volume. This fact turned out to be a blessing in disguise since if EasyGBP had been completed prior to summertime and was performing as expected I would have just sucked the performance up to ‘summer’ and simply reduced risk for July/August and went to the beach and waited for Sep to resume normal performance.

Instead, I was burning my brain trying to ‘tune’ it to work in those unfavorable conditions until it hit me. Other algo traders have MULTIPLE systems that switch modes depending on conditions. Until that point I didn’t even think to make a SCALPING TRADER. After I thought about it for a bit it made so much sense. Scalping systems don’t need as much momentum as my ‘trading’ system, they WIN much more which is psychologically easier to deal with, they also have smaller losses and lower risk profiles.

It took me 3 tries to develop one I’m happy with and it’s really a cross between a ‘traditional’ scalper that I think of that might only net 3-5 pips but risk 50+ pips with a SL (which discouraged me from ever making a scalper). Developing my version of a ‘scalping system’ after programming a traditional ‘trading’ robot gave me the best of both worlds. My ‘scalper’ has SL’s of 25-40 and can net small pips AND large gains (the recent $364 gain is 88 pips).

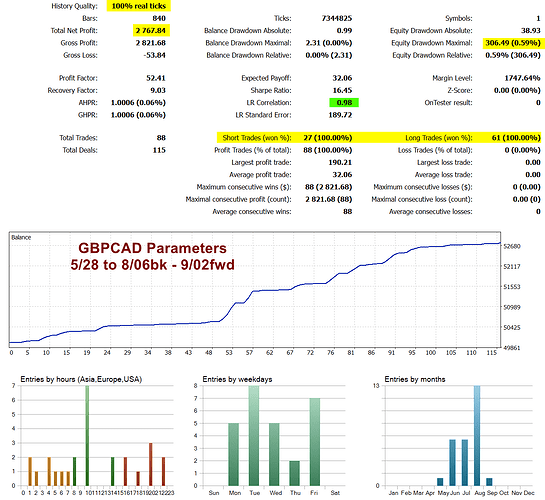

It does try to close trades quickly with a minimum of risk (90% of the trades never pay swap fees) but if the currency runs it’ll catch quite a few pips while still keeping drawdown to ridiculously low levels. I’ve developed it using MT5 and its so efficient that I can test it quickly using only my desktop using 100% real-ticks with embedded spread (instead of requiring cloud rendering for speed) to get accurate backtesting results. To create ‘settings’ files I’m doing 60/30 - 60 days of backtesting and 30 days of forward testing. GBPUSD is killing it with fantastic results that reveal that most parameter combinations produce profitable results. I’m simply picking the SET file that presents the best backtesting AND forward testing balance graph then I run a backtest of the entire 90-day period using those settings to ensure they would work for that whole period.

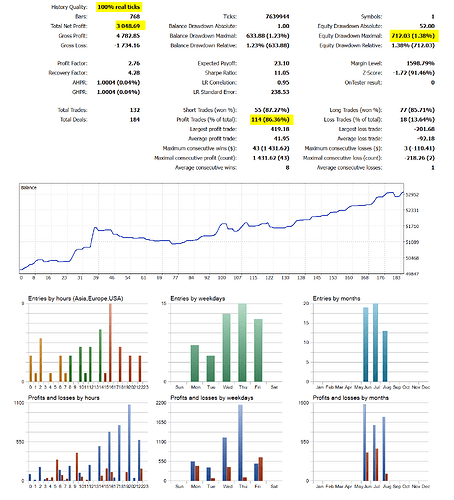

Here’s the current backtest for the settings that are active right now. In fact, the scalper is such a reliable and low-risk trader that I’m sold on using it as the core system from this point forward.

Below I’ve posted the current FORWARD Test and BACKTEST results and good grief GBPUSD just creates tons of great settings and this is only risking 0.50% per trade. I could DOUBLE these results by only risking 1% per trade. The current C2 results are from risking 0.40% per trade since I wanted to see it trading LIVE for a few trades before I start ratcheting it up. It’s still at 0.40% but by weeks end I’ll have turned it up to 0.50%. Also I’m backtesting other currencies but GBPUSD gives such reliable results that simply increasing risk might be the best solution (even though AUDUSD looks promising)

In the following chart, the ‘Forward’ profit is 3-weeks (7/31 to 8/25) and the ‘Backtest’ profit is 2 months (5/28 to 7/30). It easily profited during the ‘flat’ period and amazingly most parameter combinations worked well during the period. Almost impossible to pick a ‘bad’ set. Also note how LOW the forward testing period drawdown is. In addition, the robot is based on pure price-action mechanics and the only indicators it uses are MA’s and standard deviation to measure volatility (I use it as a filter to avoid ‘flat’ periods).

Like I stated previously this ‘scalper’ benefits from my previous price-action robot stripped of the CPU-crushing complexity. I took the best parts of it and used them to create a smarter ‘scalping’ system. Fun Times coming up!!