FINALLY SETUP!! - Good Grief, its almost impossible to setup a reliable system for creating stable parameters even when you have the proper tools. I’m looking back at my first Walk-Forward tests posted above and EasyGBP system stability has increased exponentially over the last 2 months even though its not too visible from my current LIVE chart.

Most trading systems don’t support proper walk-forward testing and only have simple backtesting which I will never naked trust again. Once you run those same GREAT parameters through a test of the upcoming months unseen data 70% FAIL!! In the ‘old’ days you didn’t have a choice and had to hope you were ‘lucky’ picking from the hundreds of possible combinations.

Fortunately, Walk-Forward analysis can discard the majority of those forward-unprofitable settings so the problem shifts. What ‘fitness’ parameters are you going to use as ranking criteria? (wf-analysis returns one set of parameters ranked as ‘best’ by your criteria)

Getting your optimizations to produce parameters that are reliable and leverages the way YOUR system trades is very hard to do. I eventually had to ditch all of the presets and create a custom formula that focuses on Profit Factor, Drawdown and Sharpe among other criteria.

After I posted the previous article I started the insane process of optimizing my robot for walk-forward analysis (an extensive process or you’ll get curve-fitted results). I used the paid MQL5 cloud network to get 400+ computers to help me crunch the numbers as I tested out different formulas. I ran 100+ optimizations over the next few months that would have taken my single computer YEARS!!

What’s The Result?..

INCREDIBLE!! - Walk-Forward finds me parameters that have true predictive value!! At first, I only used results that were ALL green but after testing its actually MORE important that the LAST few bars which represents the current market have acceptable parameters. As a result, I prefer profitable last-bars that have 10+ trades and roughly 50% are winners.

I do one further test to validate the parameters suggested. Example: GOLD. The lime-green bar lists the settings to use. I’ll take these settings that are supposed to be valid for only 05.23.2023 to 07.22.2023 and run an optimization for THE ENTIRE YEAR to see if they really are stable.

Before I show you the result, let me rant briefly about GOLD!! - My EA trades it AMAZINGLY!! - Its moves a lot and when it swaps money with my EA it always loses BIG. My EA limits losses but lets profits run so Gold is a sucker for it over time BUT I cant figure out how to trade gold on C2 through MT4/MT5 (can C2 accept XAUUSD?). I looked up a couple of Gold systems and didn’t see any instrument I could replicate. (rant over)

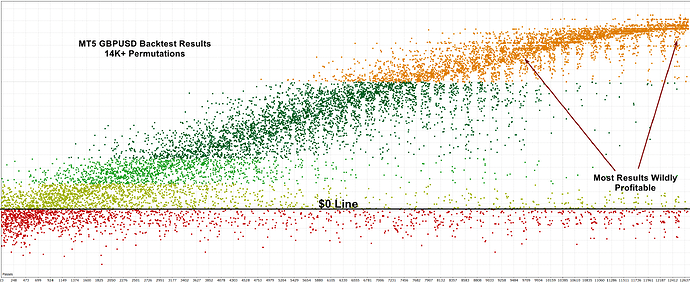

GOOD GOOGLY MOOGLY!! - Finally a backtest I can give some credibility. Now instead of using backtest to HOPEFULLY find parameters. Now I just use it to do a quick validation YTD. The first time I did it I was BLOWN AWAY. I don’t know if I have ever run a raw backtest and seen such a beautiful equity curve!! I actually expected them to start out BAD and get better the closer you get to 05.23 (current optimization). This shows me that I finally have a process that can extract STABLE settings (Whew!). Not the Best. Not The Worst. Just The Most ROBUST.

Doing the same with the remaining currencies (the only ones I can run on C2) results in:

WOW!! - I was simply Floored! I did not expect (no matter how hard I tried) to end up creating sets of parameters that would be so stable. I’d be the first to admit it wasn’t easy and a couple times in the process I really doubted it was even possible. I had no idea.

July will be the first full outing for the system. Unfortunately, we’re headed for ‘summertime’ trading and August which I will only trade with reduced risk (usually the worst month besides Xmas/New Year) since volume really ratchets down as people vacation but I anticipate impressive results for Sep to Dec until I stop trading right for Xmas to New Year.

After 10+ years of toying with algo’s its hard to believe I’m almost at the finish line. The only thing left now is REAL-TIME results. Must be an omen. Day before July 4th and I really get to take off and enjoy it. I’ve done the work. The optimizations are complete. The setting have been applied to the VPS and are ready to start trading. I guess I finally get to eat Burgers and Hot Dogs This Year. HAPPY JULY 4th C2 TRADERS!! - EasyGBP Is Ready For Prime Time.

Below I’ve added a couple more screenshots. I loaded the resulting backtests into a strategy analyzer to get an overview of the trading-basket performance. Regarding the currencies, the resulting parameters have very low drawdown so I have plenty of room to safely increase lotsize to boost profits even further. GOLD is just a BIG earner since its moves so much.