I see your point. Can’t agree that use of averaging down for high-leveraged futures and forex means better strategy.

@JITF It is not coincidence. The reason is high leverage on the futures and forex and low leverage on stocks. Max leverage on stocks you can get is 2, and I didn’t see here at C2 traders having less than 2-5 on futures. More often it is 20-40.

I assume that 2-3 forex/futures strategies after 1000 trades have leverage comparable to stocks leverage, thats why they survived.

Low leverage may help to survive, but not to make profit.

@JITF So lets compare two strategies with 1000 trades, one based on 3 month period and one based on 10 years period. Both are good from your point of view, but I bet the latter is more reliable since it covers different market regimes.

Daniel’s evaluation is not the competition between strategies. He just evaluating strategies - one by one.

Ok, I see, thanks for clarification. Honestly I thought the goal was to offer the way to choose the best strategy based on certain criteria. But it seems that it is just number tossing, evaluation for evaluation only.

We are talking about strategy similar to your strategy for your example here:

But instead of 200 and 1000 trades per 10 years, it will be 1000 trades in 3 months and 10 years. What strategy is harder to generate?

Let’s turn to the numbers.

Not averaging down. Step lot raising; This implies the profit-loss ratio 3:1 or better and full control over position side management.

I chose three strategies based on these criteria for an 6 months investment horizon and added them to my simulation account.

Everything that I do has a practical application.

Equally.

Your question is based on the assumption that the 2008 market was very different from the 2010 market.

In terms of volatility - yes, but in terms of the price movement laws - no.

1000 trades are made according to some pattern, and it depends only on the position of the bars; It doesn’t matter which ones (daily, hourly, minute, tick). Therefore, from a technical point of view, 1000 trades on daily bars are the same as 1000 trades on minute bars.

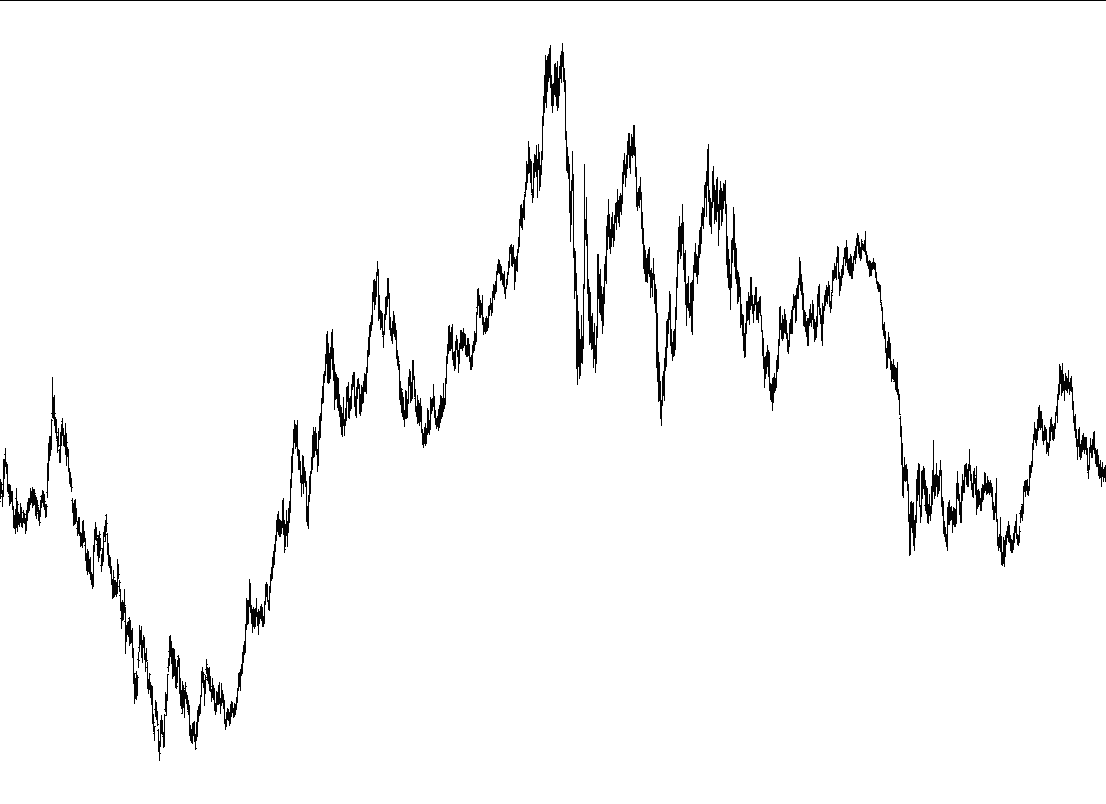

Guess where is 1M, 1H, 1D, 1W?

VERY interesting analysis. I am new to Trading and C2. Is it possible to follow you – like Twitter? Or, do I just have to keep looking for your comments?

Thanks,

Dave

Hi Dave,

Thanks for your interest!

Most activity is on this forum, but of course you can follow me on other social platforms.

LinkedIn: www.linkedin.com/in/riabitskyi/

Twitter: twitter.com/TradeWait

Competition means at least:

- Exact rules.

- Ranking.

- Fixed number of winners.

Current evaluation, if to be short, should give the answers:

- What is the alpha of the strategy in.

- To invest or not to invest.

- If to invest - than what is the minimal time horizon.

My own strong opinion - all competitions in trading brings huge harm and are nonsense.

This is like to evaluate magic or anti-gravitation: it is enough if it just exists.

To give answer to this question we should get agreement whether the market is fractal or not.

All my tests and visual comparison say, that it does (except in boundary cases of 1 tick and 1 century bars).

And, if market is fractal - only number of trades means.

Of curse, I agree that 10 years and 1000 trades is better than just 1000 trades.

- Marker is fractal.

- Marker is not fractal.

0 voters

4 out of the 7 strategy you reviewed started in 2019. strategies that never been thru a 5% pull back. I wont put any real $ in a strategy without knowing how they do in Nov-Dev 2018. how long a strategy been around is more important than how many trades they made imho

So leverage of the forex/futures strategies left is around 3 to 9 (sorry I can’t consider Zip4x as a normal strategy). Decrease the number of days to 300-500, you will see the leverage up to 20, even 30. So 3-9 leverage is small leverage. I assume it would be more forex/futures survivors if less leverage will be used.

Returning to that 27 strategies stayed alive after 1000+ days with the annual return of 20%. 2 forex, 3 futures, 5 options, so 17 “stocks” strategies left. From these 17 only 9 was trading stocks, 6 was trading volatility ETFs and 2 gold ETFs. So only 9 pure stock strategies against 2-5 futures/forex/options strategies. Seems trade stocks not that much easier as you described.

Do you mind to show the example of the strategy with the averaging down with 3:1 profit-loss ratio? Usually it is opposite, 1:3 or even 1:10 in the long run with 80-90% loss at the end.

Mr @AndriiVdovenko2 has another opinion. ![]()

I’ll get back on this. Interesting question.

High leverage will not help you to make profit long term. Confirmed by hundreds of failed traders on C2.

Honestly I lost your point.

Seems some contradiction exists between these two phrases. If the only number of trades is important, than why is additional condition of 10 years make it better? And what about my question: what is better 1000 trades in 3 months and 1000 trades in 10 years?

You confuse the averaging of an open position with a stepwise volume increase in the next trade.

All strategies selected by me have a step lot raising and, in all of them, the ratio in favor for profit trades.

For example Carma Managed Futures - 2.35:1

Your question was not like that

Generate and select is not the same thing. It is equally difficult to generate both 3-month and 10-years.

If you come across two strategies with 1000 trades, then of course it is better to choose with a 10 year history.

This is an interesting thread, I appreciate the discussion.

On this site everyone is making 50%+ a year over 1 year it looks like. Hard to find anything that’s not a data overfitting. If anyone can make 50%+ a year consistently they are doing better than the best hedge funds in the world (rentec, etc) so it’s highly unlikely that anyone can keep that record up long term.

Selecting an effective strategy on this site is mostly impossible imo - this site is primarily useful for having an audited track record of performance, separate data will be needed to gauge long term effectiveness - the couple years most of the strategies have here are insufficient to make an educated opinion on a strategy’s long term effectiveness.

You need 20+ years of backtesting to have any idea if your algorithmic strategy will be long lived, if your strategy doesn’t have the ability to test like that (a day trading strategy for example) it is almost guaranteed to be ineffective over a long time period and therefore ill suited to compete with any of the big funds…

This site is best for having a recent track record imo, not for finding market beating strategies to invest in long term. Some of the stuff you find on this site may be suitable for prop trading however, which is typically going to be targeting shorter term inefficiency exploitation.

Absolutely correct…all this discussion never considers robustness of the systems. Markets change all the time thus if a small sample is taken out of the larger picture it may be meaningless. Strategies must be able to survive robustness, volatility, and liquidity issues as well as the conditions mentioned.

I agree with your comment generally.

You described the ideal conditions for the system evaluation and I would supplement this to: >10 years backtesting + >2 years real market testing + >1000 real market trades.

But this is utopia and judging by the hedge funds results - for them too.

Exactly based on the problem you described, I proposed the systems evaluation in terms of the probability of not losing, where profit is just a nice bonus.

We definitely won’t be able to predict which strategies will show the best result for the next half a year, but we can determine which ones are the least risky at the moment.

I do not claim that my approach is perfect. But it’s definitely better than alpha, beta, Sharpe ratio, etc. (it’s important to understand how the strategy generates a profit and these evaluation indicators are useless for this).

This is actually what I am struggling to understand - you position management concept. For example, Carma Managed Futures. I’ve downloaded their trades. They were trading 7 futures with constant trade size of 1 or 2 contracts. Then in 2019 in may, august and october they increased trade size on 1 or 2 contracts, but for e-mini nasdaq decrease trade size on 1. Now they are trading new constant trade size. What is the

in their case? I am not sure that they do

This strategy has a good entry signal system that gives a positive tick value. So It uses only 2-3 step lot raising in drawdown cycles. You can see this on the chart.

To know exactly how it increases the lot, what instruments it uses and when is too laborious task, and it does not have a significance.

Most of the loss trades’ duration is less than 2 days (475 of 524), so it is not averaging.

Of course I have questions to loss trades with duration over 5 days, this is a risk, but the choice of strategies is small, we have to accept it.