Easy enough to test the value of that, just adding the following filter logic to my strats running here:

These strats backtested in their current iteration to the beginning of 2022 but with the above TripleSMA Filter:

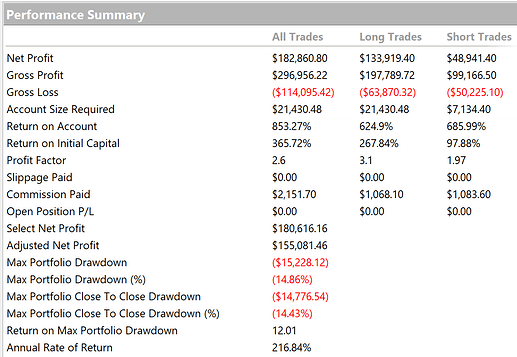

And in their current state without the TripleSMA Filter:

So, using the TripleMA Crossover as a filter for entering positions reduces my net profit by about $80K while reducing my MaxDD by about $2500. Why? Because by the time I wait for that level of trend confirmation, pretty much any edge a strategy may have to detect a trend early is gone.

To be clear, I’m not saying that the Triple MA Crossover doesn’t serve as a (rather late) confirmation of a trend direction, but by the time you get to that point, that is a FAR CRY from detecting a currently developing trend, as that ship has long since sailed by the time you reach that level of confirmation. By the time you get that level of confirmation, any edge a trading system has in trying to detect a trend direction as early as possible is pretty much gone if your TripleSMA Crossover is a filter.

Believe me, I would LOVE for you to be right, which is why I tested it, just in case. But you’re not. At least not for automated systems and/or algorithms looking for an edge.

If you would like to continue this discussion, or a discussion on any other topic you’ve read recently on Investopedia, please feel free to start a new thread, as THIS thread is supposed to be about the two strategies I publish here. Thank you.