Many. Pretty much all have crashed, burned, and gone private on C2, which is why you can’t see them anymore.

Ok JITF… no I don’t plan to wait another 14 months to the next equity high. I think way way too much emphasis is put on the majority of analytics, in terms of their predicative value in determining future performance. I have only a couple I look at. I’ll address that in another post. How many people have been burned making subscription judgements on the majority of these analytics? Alot, that’s because there so poor in their predictive value. In a word—they suck. In my case the drawdowns were not so much strategy related but faulty money management. I was often in a quandary about position sizing and risk control. Do I risk 2,3, 4 % when opening a position, with the current equity I’m trading? There are big differences between taking profits out of the markets, holding on to those profits, and adding new profits. I took to many small loses when I should risked more money. If you want to criticize me for being too cautious, too conservative, in protecting the equity, I stand guilty as charged. My equity curve would have been a little smoother but I would still be at same point I am right now.

yes, not a lot. maybe even zero.

high leverage and luck.

trading skill for me is the ability to achieve consistent results from year to year.

this is simple. go to the C2 grid and put the following criteria.

i found 27 strategies which can be compared to your strategy in terms of strategy age (which for me is best equivalent of reliability here), return and risks (drawdown). I also add min 100 trades criteria, it will be more strategies without it.

I think 1 of 27 is select company. I consider the new high list the best indicator. Speculation is hot money, its going to go where it gets treated the best. This is a (what-have-you-done-for-me-lately) kind of business. As a manager, if your not producing now, your not producing. I’m always amused at the way some people rationalize their sticking with a strategy with excuses like- he does well in trending markets but has trouble in choppy markets. The guy who said “There’s a sucker born every minute” really knew what he was talking about. Figure out how and why the strategy made the list to try and project future profitability. I have a couple of other indicators I use. I will address this in another post.

Is there any C2 study that shows that TOS (Trade Own System) strategies somehow…

1: Beat the market by some wide margin.

2: Have less downside volatility/drawdown.

?

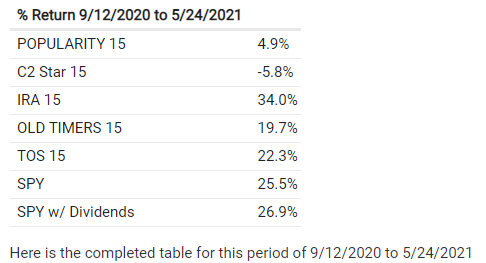

Below are the results of the relatively short test I have done with the 15 top strategies in each leader board. I rebalanced the portfolio a couple times between those dates. You can see that TOS did much better than plain popularity board. However, it certainly wasn’t the best. Of course, this is a short time period of less than a year. I have been meaning to do a rebalance and update it just takes some time so I have been putting it off. I will do it soon…

While informative, your (not statistically meaningful) short test does not take into account the hundreds of TOS systems that simply blew out over the years (survivor bias).

The average maximum drawdown of these TOS strategies (compared to SPY for example) is not revealed as well.

TOS systems as a whole are mostly crap, in fact most system are. How many systems have thrived & survived the 2 major crashes since 2008? What will probably occur based on history, the top 15 systems will Crash N Burn or end up with modest returns if they survive.

Good question.

Markets should be traded both ways (long and short), trading only the long side is total stupidity, despite the upside bias of the equity market.

Or what will happen is someone returns 600% in a bear market and subscribers will say, “yeah but he had a 45% drawdown”. You can’t win.

I wouldn’t worry too much about that, C2 history shows that some traders have no problem subscribing to 100% drawdown systems.

This is a go forward test. It needs to be a lot longer, of course. However, it has no survivorship bias in the TOS board vs the popularity board.

On the first day I took the top 15 from each board. Then a few months later measured the results and rebalanced with the current set of top 15. Then waited a few months and did it again. So there isn’t survivorship bias in the TOS board that isn’t in the popularity board.

The ones that blow up I still record on each leaderboard. The ones that go private I use the equity charting ability to measure the results.

Here is a statistically meaningful test:

Track 1,000 TOS C2 trading strategies for at least 15 years and see if they…

1: beat the market.

2: outperform 1,000 non-TOS (randomly chosen) systems

3: have smaller drawdown.

If 1, 2 and 3 are true THEN you will be able to say that TOS systems are better.

If you want to be a realist and work with what is available the data implies (does not prove for all time) the TOS results are better on average. If you want to make the metric impossible to achieve then you can say chose 1,000 randomly selected TOS strategies out of a pool of about 45.

It is a fact that over that period the top 15 TOS outperformed the Top 15 leaderboard in a go forward test.

I have seen no data to indicate without survivorship bias that the popularity and/or non-tos has beat TOS top 15.

I would love to be shown that data if it exists.

When hard earned money is on the line, “working with what is available” is simply not acceptable.

The problem with small samples is that a trader can prove anything he wants.

Even losing systems can outerperform the market, from time to time.

Do you know of data that proves or even implies that non-TOS does better than TOS?

Ironic that you say “when hard earned money is on the line” to suggest that TOS isn’t superior.

Unless you got data to even imply non-TOS is better, I’ll stick with my imperfect but available data.

I never implied or even suggested that non-TOS are “better”.

I guess I misunderstood you. I’m glad you don’t think non-TOS is better than TOS.

No harm done, keep us posted and have a good weekend Dwight.