After adjusting the portfolio in early March as I thought was optimal for the middle of 2020, I did step away from actively managing it. [I don’t recall whether I set the number of subs at zero or whether it was just my not paying my monthly fee, but the strategy and its track record was visible during the whole time, not private. C2 showed that it was not being actively managed, but it was just that I was happy with the portfolio and wanted to wait to come back and seek subs this fall.] During that period (March 4 to Oct. 20, 2020), I did no trading at all—none. The nice run-up you see in the chart between March 4 and Oct. 20 was driven by the then-existing portfolio (most of which was because of the ETFs sold on Oct. 21).

As far as I remember, the strategy has been fully public at all times and was available for subs from the time it opened in 2017 until March 2020.

The only thing that is really new here is the name of the strategy.

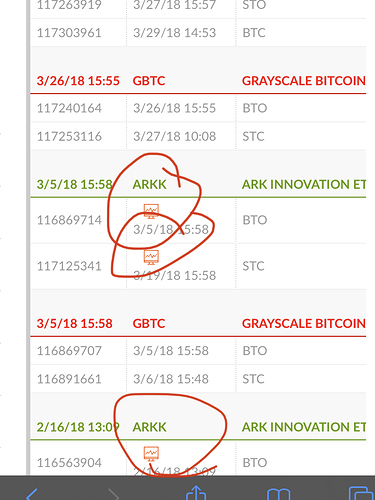

As I mentioned in an earlier post on this thread, I renamed the strategy this week, changing it from “Bitcoin Related” to “Innovation ETFs.” I had done several name changes in the first week this strategy started in Dec. 2017 and then I dropped “Aggr” from the name in Sept. 2018.

You seem almost offended that you hadn’t heard of my strategy before. The first two strategies on the screen list have changed names, “The Momentum of Now” once, and “VIX Tactical Trader” four times. Other older strategies not on the screen that have changed names include “Smart Volatility Margin,” “SystematicBlue SP500,” and “The Spirit of Nicolas Darvas.”

MarekJ did a bunch of screens in his thread in 2019 and early 2020. Except for MarekJ’s first and last screen, I believe that in every screen, this strategy had the highest annual return of any of the strategies. I was left off Marek’s first screen because I had not yet met his threshold of 100 trades. I think that I was left off his last screen in March 2020 because I had not paid my monthly plan fee to C2.

I had a few subs, but even when I lowered my subscription fee substantially, I still had very few. I suspected that some were put off by trading Bitcoin related investments and the occasional use of Bitcoin futures. I have stopped using futures and focus now more on innovation ETFs.

In March 2020, the high risk environment led me to keep most of the portfolio in cash, but I put almost all of the portion that I was investing in innovation related ETFs, my quantitative analyses suggesting to me that they would do extremely well once the pain was over. I set up the portfolio as one that was very good for the middle of 2020 and stepped away from C2 for a while.

With the election approaching and the need for rebalancing, I came back this week, renamed the strategy, made some trades, and redid MarekJ’s screen.